How Low Will Mortgage Rates Fall?

August 13, 2020

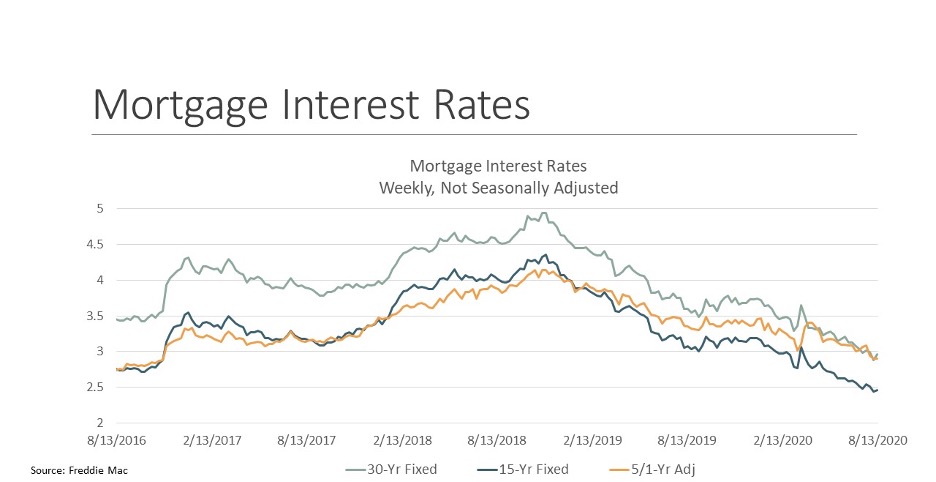

Every time it seems as though mortgage rates cannot fall any further, we hear that they have hit new historic lows. According to Freddie Mac, the 30-year mortgage rate has hit record lows eight times since the beginning of the COVID-19 pandemic and has been below 3% for three consecutive weeks. As a result of these low rates, the Mortgage Bankers Association is reporting that mortgage loan application volume increased 6.8% over a week ago, with purchase applications up by 2% and refinance applications up 9%.

Low mortgage rates can help make housing more affordable. For example, a homebuyer taking out a loan for $300,000 with a 3% mortgage rate would have a monthly mortgage payment of $1,265 (assuming no PMI). At a 4% mortgage rate, the homebuyer’s monthly payment would increase to $1,432, a difference of $168. Over 30 years, this amounts to a more than $60,000 in mortgage payments

While advertised mortgage rates are at historically low levels, potential homebuyers still face some challenging headwinds. Even as mortgage rates are falling, banks have been tightening underwriting standards since the start of the COVID-19 pandemic, which has limited credit availability to some extent and has slowed opportunities for home purchase and refinance loans. Lenders likely will continue to maintain strict loan qualification standards given the risks and uncertainties in the economy.

In addition, low rates cannot help would-be homebuyers if they cannot find a home to purchase. Inventory levels continue to drop, with the number of statewide available listings at the end of June less than half of what it was five years ago. In many local markets across Virginia, there is a great deal of competition, with many homes commanding above list price.

A big question is whether mortgage rates will stay low or even continue to fall further. Is a 0% 30-year fixed rate mortgage rate a possibility? Despite that tantalizing idea, there is little reason to believe we will see that dramatic and unprecedented situation here in the U.S. In order to see 0% mortgage rates, we would need a negative Federal funds rate and the Federal Reserve has publicly stated it is not prepared to move in that direction.

But mortgage rates should stay low for a while. According to Freddie Mac’s most recent forecast, 30-year mortgage rates will average 3.2% in 2021, which is slightly above where it is now but still very low by historic standards. What this means is that homebuyers will continue to be able to find attractive financing for at least the next six to 12 months.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More