Despite Strong Price Growth, No Signs of a “Housing Bubble” in Virginia

February 28, 2020

According to the January 2020 Home Sales Report released by Virginia REALTORS®, the strong economic fundamentals and low inventory across the Commonwealth are the cause of the steady rise in home sale prices statewide.

Despite recent headlines speculating on the probability of another housing bubble, Virginia’s robust demand and limited supply—fundamentals indicative of a healthy economy—are the driving forces behind the rising prices.

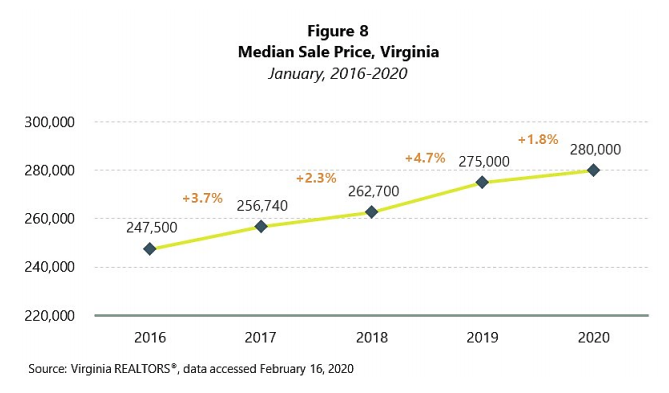

In January 2020, the statewide median home sales price was $280,000, an increase of nearly 2% over January 2019. At the state level, home prices have been increasing steadily since 2012, reflecting strong demand and declining inventories.

“While home prices have reached the peak levels seen during the height of the housing boom, there is no evidence of a bubble because price appreciation now is much more modest,” says Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD. “Recently, Virginia has been experiencing modest and steady annual price growth of 2 to 4%. Back in 2004 to 2006, we were seeing 16 to 20% annual price growth. During the housing market boom of the middle of the last decade, the double-digit price growth was driven by other factors–particularly loose lending requirements–which are not present now.”

The growing lack of available homes has created a challenging market for buyers. Virginia’s inventory of homes for sale has shrunk considerably over the past five years. At the end of January 2020, there was a total of 28,538 active listings across the Commonwealth, more than 10,000 fewer than a year ago, a decline of 26.4%. The available inventory at the end of January is just about 60% of the level available four years ago, at the end of January 2016.

The fastest price growth between January 2019 and January 2020 was in the Southwest (+11.6%) and West Central (+10.7%) regions. There was also strong price growth in the Hampton Roads region, where the median sales price increased by 7.9%.

With Virginia experiencing steady job growth and strong economic fundamentals, Sturtevant says, “I don’t think we would be seeing so much speculation about a housing bubble in this current market if we were not still reflecting back on what happened 15 years ago. But this is a very different market now.”

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More