Virginia’s Veterans’ Powerful Impact on the Housing Market

November 13, 2019

By: Virginia REALTORS® Chief Economist, Lisa Sturtevant, PhD

Across the U.S., veterans comprise 7.3 percent of the population (age 18 and older). Virginia is one of four states where the veterans account for more than 10% of the population. (Alaska, Montana, and Wyoming are the others.)

Veterans tend to have a higher median income and lower unemployment rates than those who did not serve in the military. In many parts of the state, veterans—along with active military service people—are a major part of REALTORS®’ business.

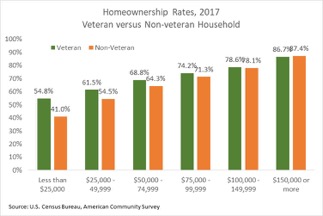

Across income groups, Virginia households are more likely to be headed by veterans than nonveterans. Overall, 72.5% of veteran households are homeowners, compared to 64.4% of nonveteran households. The biggest advantage veterans have is seen among lower- and moderate-income households. For example, statewide 54.8% of veteran households are homeowners, but just 41.0% of nonveteran households own a home. For households at the highest incomes, homeownership rates tend to be more similar.

Veterans also tend to own higher-valued homes. In 2017, the median home value for Virginia veteran households was $330,768, while the median for nonveteran homeowners was $323,971. They also live in slightly larger homes (3.4 bedrooms versus 3.3 bedrooms, on average).

The National Association of REALTORS® released a report on homebuying among veterans and activity duty military. Among the key findings from that national study:

- Over 40 percent of veterans completely financed their home with no down payment

- 58 percent of veterans used a VA loan while one-third used a conventional loan

- Veterans are more likely than nonveterans to purchase a multi-generational home (17% of buyers compared to 12% of nonveteran buyers)

- 63% of veterans stay in the same state where they bought a home

- 19% of veterans are first-time homebuyers.

Recent data from the Department of Veterans Affairs suggests a steady decline in the overall veteran population in the U.S. over the next five to ten years. Virginia’s veteran population is expected to decline much more slowly than in most other parts of the country. Therefore, veterans will continue to be an important part of the Virginia population. However, the characteristics of veterans, and therefore their home buying preferences, are changing. What do REALTORS® who work with veterans need to know?

- Gulf War-era veterans now account for the largest share of veterans, surpassing Vietnam-era veterans. The veteran population is getting younger and more racially and ethnically diverse, as veterans of the Gulf Wars begin to be a larger share of the veteran population. As a result, these younger veteran households will include more first-time homebuyers and families with young children. They may be looking for smaller and/or lower-priced homes compared to other veteran homebuyers.

- Most veterans move in-state, and many make a short-distance move. According to the NAR report, nearly 40% of veterans purchase a home within ten miles of their previous residence. Many move for a new job. In Virginia, understanding changing employment opportunities for veterans in your market will help you understand how to best serve veterans who are potential homebuyers.

- More veteran homebuyers will be women and single individuals. Similar to the homebuying population, the shares of veteran homebuyers who are women and single people living alone is on the rise. According to NAR’s report, more than half of veteran homebuyers purchased in the suburbs. However, these female and single homebuyers may be more likely to be looking for homes in urban areas closer to jobs and amenities.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More