Under One Roof: The Rise of Multigenerational Households in Virginia

October 10, 2019

By: Virginia REALTORS® Chief Economist, Lisa Sturtevant, PhD

In recent years, particularly since the Great Recession, multigenerational living has been on the rise across the country and in Virginia. Economic and demographic factors are the primary reasons why more people are living in multigenerational settings. These factors will continue to shape the market for homes that can accommodate multiple generations, whether homes with separate living areas or homes with accessory apartments (i.e. “granny flats” or “in-law suites”) on the property.

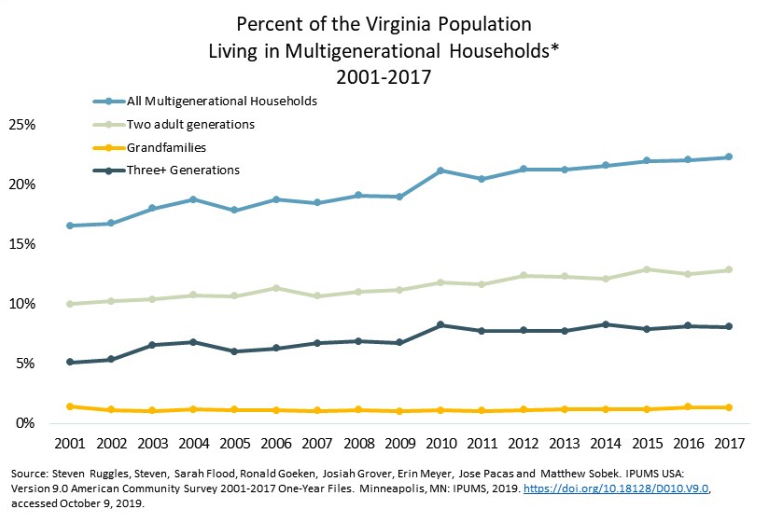

In 2001, about 16 percent of Virginia residents lived in multigenerational households; in 2017, that share had risen to 22 percent. In other words, more than one in five Virginia residents lives in a multigenerational household, which is defined as:

- Three or more generations (e.g. grandparents, parents and children);

- Two adult generations consisting of adults and adult children (age 25+); OR

- Grandfamilies, which are households headed by grandparent living with a grandchild (under age 18).

There have been increases in all types of multigenerational households but the most notable growth is among 25 to 34 year olds living with their parents. In 2001, just 12 percent of 25 to 34 year olds in Virginia lived a multigenerational household. By 2017, that share had risen to 26 percent, meaning that more than one in four 25 to 34 year olds in the state lives with his or her parents.

There are several reasons why we have been experiencing an increase in multigenerational living in Virginia, but they generally fall into two categories: economic factors and demographic factors. The economic downturn and housing market crisis were key reasons for the recent increase in the number of multigenerational households, particularly households that include parents and their adult children. According to a 2011 survey, two-thirds of U.S. residents living in multigenerational homes said they were doing so for “economic reasons.”

In addition to the challenging economy, there are several key demographic trends that are driving the rise in multigenerational living:

- The aging of the large Baby Boomer population has created more demand for multigenerational living as this population moves into their 60s and 70s.

- Young adults are getting married later and having children later, and as housing costs continue to rise, more people in their 20s and even 30s are living with their parents in order to save money.

- Immigration is another big driver of the increase in multigenerational households. In the past four decades, immigration to the U.S. has been largely driven by immigrants from Latin American and Asian countries, who tend to be more likely to live in a multigenerational household.

What does the rise in multigenerational living mean for REALTORS® in Virginia?

- Gen X’ers are key buyers. In the past, Baby Boomers were the most likely buyers of multigenerational homes, but Gen X’ers (age 39 to 53 years old) surpassed Boomers this year in being the most likely group to purchase a home designed for multigenerational living.

- Financing can be challenge. In some cases, multiple generations are pooling resources to purchase a home together, which can make finding financing tricky. Fannie Mae recently began offering a new loan program specifically designed for multigenerational families.

- Multigenerational features are key selling points. Sellers can make their homes more attractive to multigenerational buyers if they have flexible spaces, as well as privacy for individual family members that can accommodate multiple generations. Accessory dwelling units (e.g. basement apartments, garage apartments, tiny homes) can be a major selling point. Rules regarding accessory units vary from place to place.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More