Third Quarter Home Sales Report Shows an Increase in Total Volume But a Decrease in Inventory for Entry-Level Buyers

October 23, 2017

The 2017 Third Quarter sales report was released today, revealing the year-to-date market volume (the sum of all transactions) ending 2017 Q3 grew 8 percent over the year-to-date volume for 2016, totaling $31.962 billion (up from $29.548 billion). The sum of sales in the third quarter was $11.388 billion.

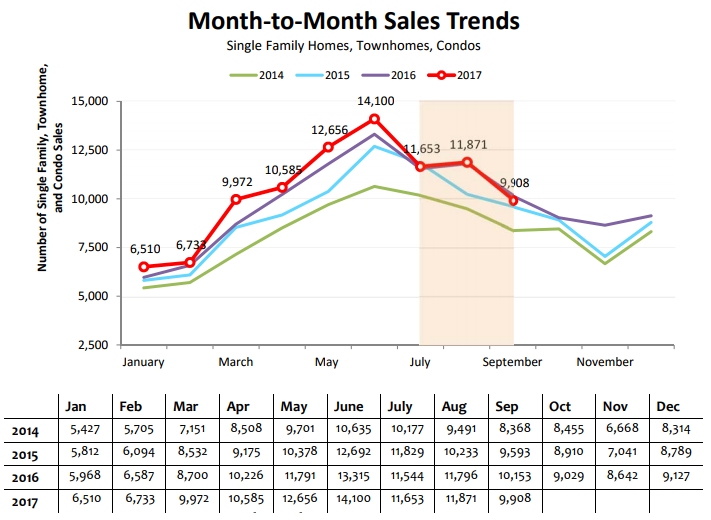

For the third quarter, pace fell slightly year-over-year by 0.2 percent (from 33,493 to 33,432 transactions). Notably, annualized residential sales, the rolling sum of sales for the previous twelve months, fell 0.1 percent from the previous quarter measure to 120,786 sales (from 120,847). This disrupts a trend of eleven consecutive quarters of improvement in Virginia’s annualized residential sales.

Average days on the market declined year-over-year by 10 percent, from 61 to 55 days.

Median price rose 2.9 percent year-over-year, from $272,000 in the third quarter of 2016 to $280,000 for the third quarter of 2017.

Third quarter sales grew in high price categories, but fell significantly in the lowest bands ($0-$200K), where the bulk of sales potential exists because they are the price categories accessible to entry-level and first-time buyers.

The Virginia unemployment rate held at an average of 3.8 percent for the third quarter. The Virginia unemployment rate continues to track below the national rate (4.4 percent). 30-year and 15-year fixed mortgage interest rates fell for the second time quarter-over-quarter (to 3.89 percent and 3.17 percent, respectively).

To read the Virginia’s 2017 Third Quarter Home Sales report in its entirety, click here.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More