Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

July 24, 2024 - Robin Spensieri

Welcome Virginia REALTORS®

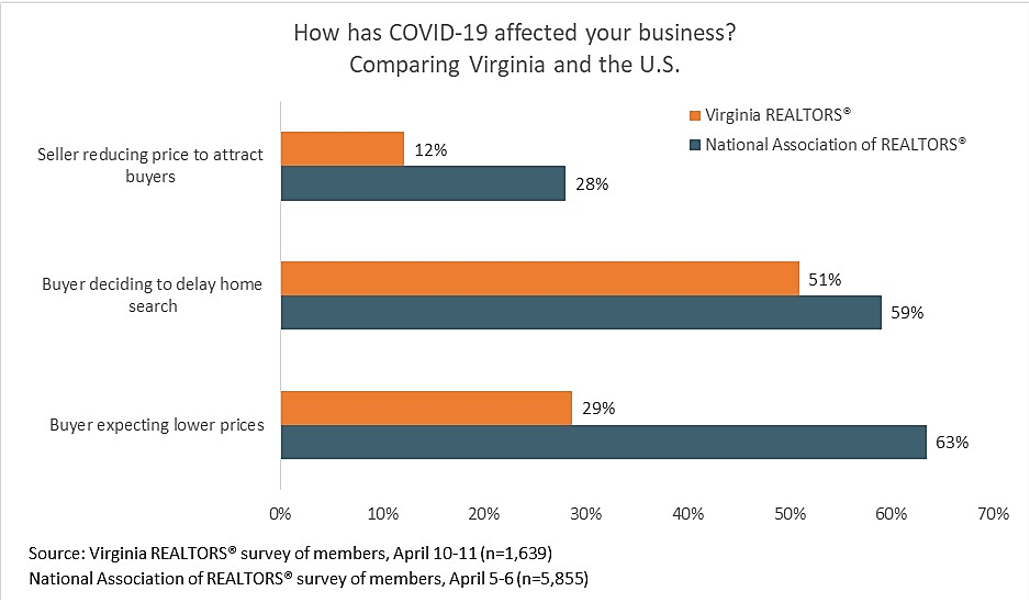

Virginia REALTORS® has conducted surveys of members for the past four weeks, asking members if and how the COVID-19 outbreak has impacted home buyer and seller interest and behavior over the prior week. This week’s survey was conducted over April 10-11, 2020 and focused not only on the impact of COVID-19 on buyer and seller behavior but also on members’ experiences in applying for COVID-19-related financial assistance. We received responses from 1,639 REALTORS® that had been actively conducting business during the past week. Results from our members were compared to findings from the National Association of REALTORS® recent member survey.

Highlights from the survey of Virginia REALTORS® members include the following:

Applying for SBA Loans

As more individuals, families and business face hardships as a result of COVID-19, the Federal government has made different types of financial assistance available. A key program, the Small Business Administration Paycheck Protection Program (PPP), is intended to cover payroll and other expenses of small businesses—including sole proprietors, independent contractors and self-employed persons—that have been impacted by COVID-19.

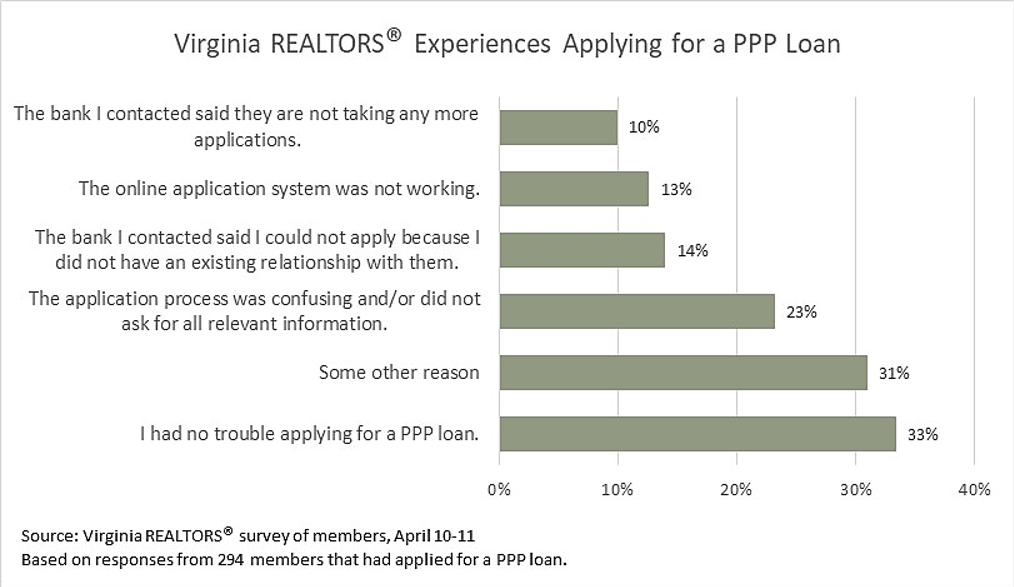

One out of five Virginia REALTORS® said that they have applied for or attempted to apply for an SBA PPP loan. About one-third (33%) of those that applied said they had no trouble applying for the loan. Among those that did experience challenges, the most common issue was that the application process was confusing and/or did not ask for all relevant information (23%). Others said that they could not apply with a bank because they did not have an existing relationship (14%) and one in 10 said that the bank they contacted was no longer taking applications.

There were a range of other issues mentioned, as well, including a lack of communication about completed applications, contradictory or confusing information about loan eligibility, and a lengthy process of contacting different lenders.

A note about surveys: This is not a randomized sample survey of Virginia REALTORS® members. However, the number of responses and the geographic coverage of respondents make it possible to draw conclusions about the population of Virginia REALTORS® conducting business in the prior week, with a certain level of confidence. These statistics from this survey have a margin of error of between +/- 2.5 and +/- 5%.

Virginia REALTORS® will continue to monitor the economic and housing market impacts of COVID-19 in Virginia. Information about financial assistance available to individuals and businesses impacted by COVID-19 is available on the Virginia REALTORS® website. Each Thursday afternoon at 4:00 p.m., we will host a Facebook Live on the impact of COVID-19 on the economy and the housing market. For more information, please contact Lisa Sturtevant at lsturtevant@virginiarealtors.org.

July 24, 2024 - Robin Spensieri

July 16, 2024 - Sejal Naik

July 15, 2024 - Dominique Fair