First-Time Home Buyers: NAR 2022 Profile of Buyers and Sellers

February 9, 2023

The real estate market has been on a roller coaster ride for the past few years. Many people have felt the effects of the market’s highs and lows, but first-time home buyers have been hit the hardest. High home prices, rising interest rates, and limited inventory have sidelined a large portion of new buyers waiting for the market to shift in their favor. The National Association of REALTORS® released their 2022 Profile of Home Buyers and Sellers breaking down how their characteristics have changed over the past year. Let’s dive into some of the key findings.

The median age of new buyers went up as their demographics shifted.

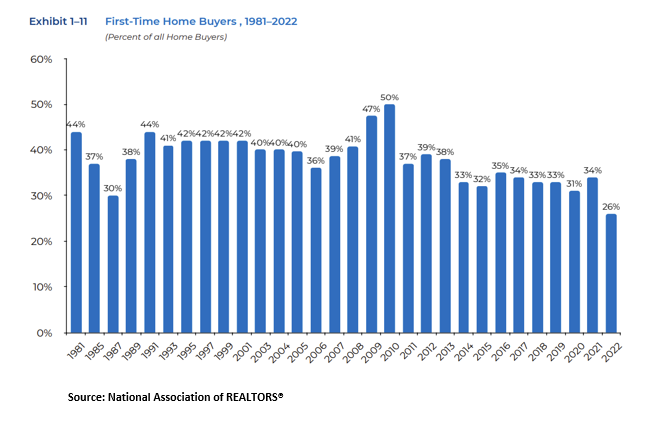

According to the NAR report, the age of a first-time homebuyer reached its highest median age since the survey began, 36 years old, up from 33 in 2021. A large part of this jump in home buyer age is due to the rise of prices and mortgage rates as many first-time buyers have had to wait longer to buy their first home than in previous years. The culmination of these factors led to the percentage of new buyers falling from 34% to 26% in 2022. As many first-time buyers grapple with affordability, they are putting off making huge life decisions such as buying a home or getting married. The number of first-time buyers that were unmarried slightly increased last year from 17% to 18% while married couples accounted for 49%, down from 50% in 2021.

Real Estate agents are a key source of information for new buyers.

For first-time buyers, 51% stated that the most challenging step in the home buying process is finding the right property. It is also the first step that first-time buyers take, with 31% using the internet to look for properties being sold. As the internet continues to be used as a tool for finding homes, 83% of new buyers view their real estate agent as the most useful source of information when searching for a home. Of first time-buyers, 82% stated that the most important benefit they received from their agent was helping them understand the home buying process.

First-time buyers bought mid-sized homes in suburban areas.

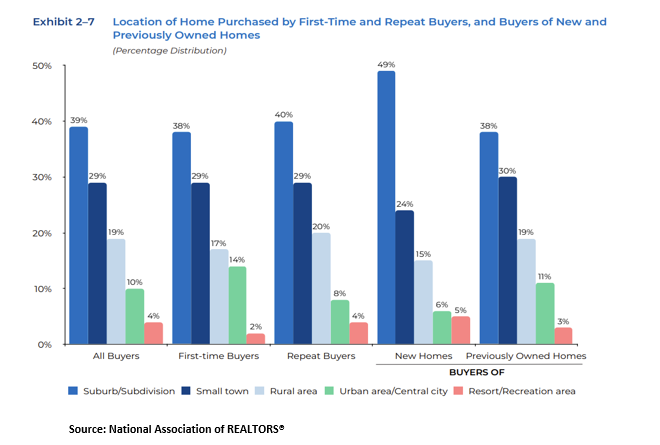

A single-family detached home was the most common type of home purchased by first-time home buyers at 76% followed by manufactured/mobile homes at 8%. During the pandemic, we saw more people looking for homes outside of the city as the need for additional space became more of a necessity for many. Of first-time buyers, 38% purchased a home in a suburb/subdivision, 29% in a small town, 17% in rural areas, and 14% in urban areas. The homes that were typically purchased by a new buyer had a median size of 1,550 square feet, with a median number of three bedrooms and two full bathrooms.

Affordability is a challenge, but homeownership is still a good investment.

As inflation continues to increase the cost of everything, from gas to a carton of eggs, income levels for new buyers have not kept up. For first-time buyers, their median income went down from $86,500 in 2021 to $71,000 in 2022, making it harder to save for a home. But even with these challenges, 88% of first-time buyers believed that buying a home was a good investment in 2022, up from 86% in 2021. While the majority, 64% of new buyers, rented an apartment or house and the percentage living with family or friends before moving into a new home increased to 27% last year.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Key Takeaways from NAR’s 2024 Profile of Home Buyers and Sellers

By Sejal Naik - December 9, 2024

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of recent home buyers and… Read More

Key Takeaways: October 2024 Virginia Home Sales Report

By Virginia REALTORS® - November 22, 2024

Key Takeaways There was a surge in closed sales activity in October in Virginia’s housing market. The influx of sales was driven by a jump in pending sales… Read More

A Profile of Renters in Virginia Over the Last Decade

By Dominique Fair - November 14, 2024

Renters have experienced a series of ups and downs in the rental market over the last 10 years. The U.S. Census Bureau has released their American Community Survey… Read More