Where Are the Most Competitive Housing Markets So Far in 2022 in Virginia?

June 6, 2022

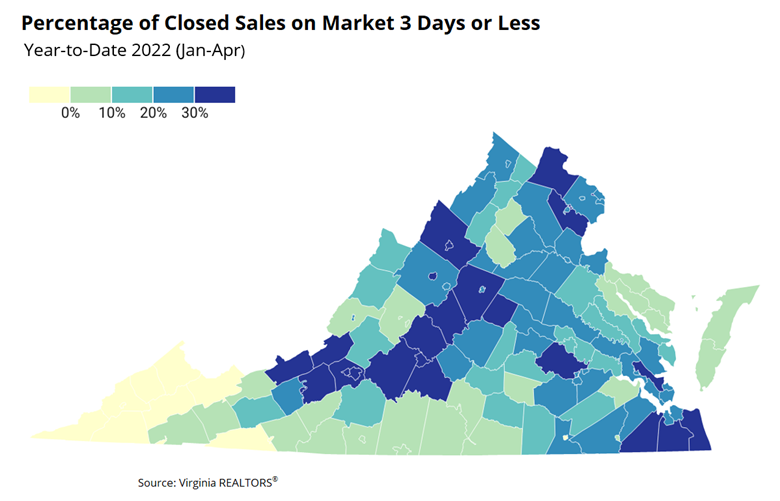

While buyer activity has slowed down from record levels a year ago, many local housing markets around Virginia remain very competitive. It’s still tough out there for buyers, but just how intense is it? We took a closer look at the market data so far in 2022, January through April, to uncover where the most competitive markets are in the state. The inventory is tight just about everywhere, so we analyzed days-on-market data and how much sellers are getting over their list price to gauge competitiveness.

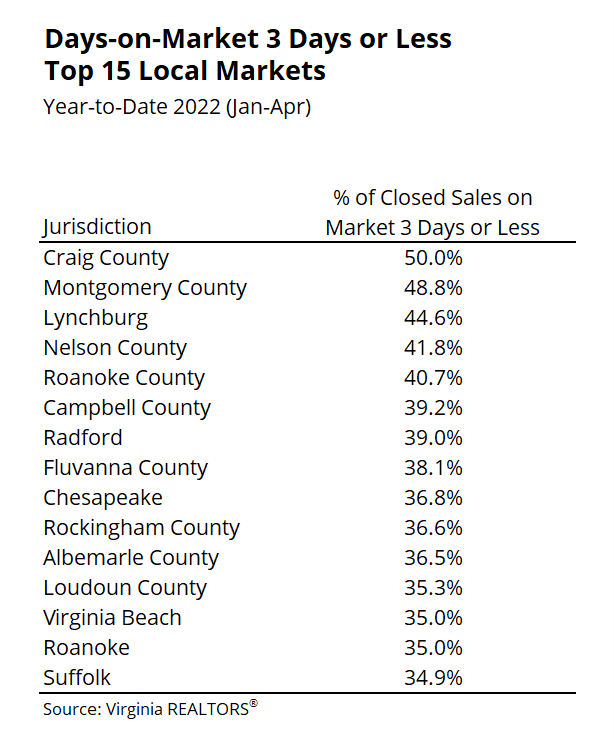

A quarter of all homes sold in Virginia so far in 2022 were on the market just three days or less.

There have been nearly 40,000 closed sales across the commonwealth in 2022 and about 26% of those sales were on the market for just three days or less. Many of the local markets in southwest Virginia, particularly the New River Valley and Roanoke Valley markets, had the largest percentage of sales fall in this category. For example, about half of all homes sold so far this year in Montgomery County (48.8%) were on the market just three days or less. The Roanoke County housing market had about 40.7% of sales in this category, and 39% of homes in Radford sold in three days or less. Homes in the Hampton Roads market have also been selling very quickly thus far in 2022. About 36.8% of all sales in Chesapeake had a days-on-market of three days or less, and similar market trends have occurred in Virginia Beach (35%) and Suffolk (34.9%). Several of the local markets in both the Charlottesville and Lynchburg regions also had a large share of sales on the market three days or less including Lynchburg (44.6%), Nelson County (41.8%), Campbell County (39.2%), and Albemarle County (36.5%).

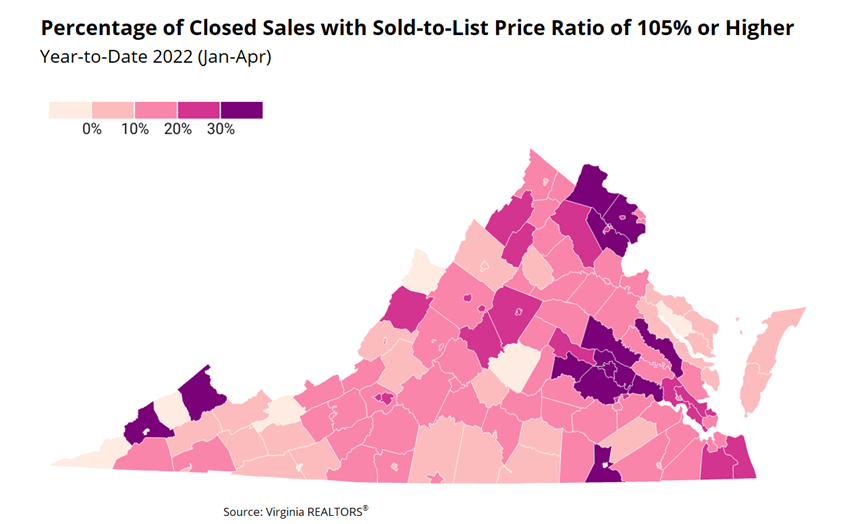

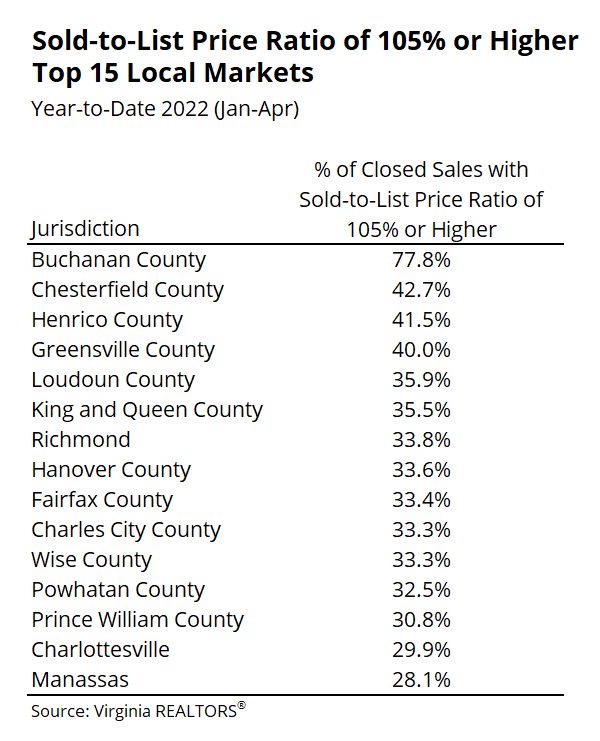

So far in 2022, nearly 10,000 home sales across Virginia closed at 105% or more of the asking price.

Upward pressure on home prices has been a widespread trend for many years in the commonwealth. While climbing mortgage rates will likely slow down the price growth, many local markets in Virginia continue to see price points close well over the list price, which suggest upward pressure continues to be a significant factor in some areas. A closer look at the price data reveals that the most intense price pressure has been occurring in the Richmond Metro market and Northern Virginia. For example, 42.7% of all sales in Chesterfield County so far in 2022 closed at 105% or more of the list price. Similar price pressure has occurred in neighboring Henrico County where 41.5% of all sales had a sold-to-list price ratio of 105% or more. The suburbs in Northern Virginia are also experiencing similar trends. In Loudoun County, 35.9% of all sales through April went for 105% of list price, and in Prince William County it has been 30.8% of all sales. In Fairfax County, Virginia’s largest local housing market, about a third (33.4%) of all sales so far this year have closed at 105% of list price or higher.

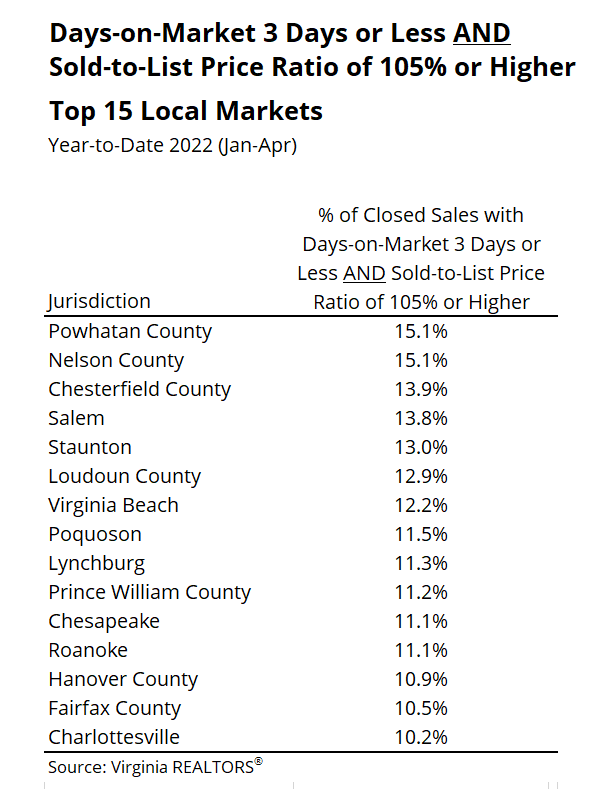

So which markets are the most competitive based on this data?

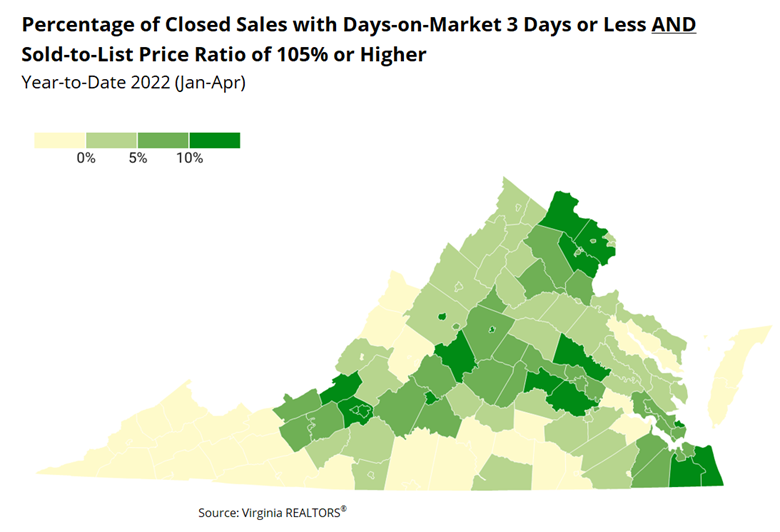

As we all know, “competitiveness” is somewhat subjective, and can vary widely depending on the type of properties on the market and the pool of buyers that are active at any given point in time. That being said, if we look specifically at closed sales that sold quickly (3 days or less) and had price levels well above the list price (105% or more), we begin to see where buyer competition appears to be the most intense so far in 2022. Only 8% of the nearly 40,000 sales in Virginia so far this year meet both of these criteria, but they are highly concentrated in only a few regions—the suburbs of Northern Virginia, the suburbs of Richmond, parts of Hampton Roads, and areas in the Roanoke and Charlottesville regional markets.

For more information on economic, demographic, and housing market trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights Blogs and our Data Page.

You might also like…

Key Multifamily Market Trends from the Fourth Quarter of 2024

By Sejal Naik - January 14, 2025

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Three Predictions for Virginia’s Housing Market in 2025

By Ryan Price - January 8, 2025

Virginia’s housing market in 2024 was marked by a slight uptick from the slowdown in 2023. Home sales activity increased modestly despite high mortgage rates. The additional sales… Read More

Are HOA Communities Becoming More Popular?

By Abel Opoku-Adjei - January 6, 2025

Homeowner association communities (HOAs) have been gaining popularity in recent years, and there’s no sign that this trend is slowing down. In 2024, there were approximately 369,000… Read More