Where Have All the Starter Homes Gone?

April 29, 2022

What do you think of when you hear the words “starter home”? Is it a small single-family home on a tidy lot? A townhouse in a new suburban development or a duplex in an up-and-coming part of the city? Right now, when people hear “starter home” a lot of them are thinking “unicorn”—an amazing, mythical thing and impossible to actually find.

One way to measure the number of starter homes available in the market is to count up the number of homes that are affordable to a first-time home buyer, whether an individual, couple, or family. First-time home buyers tend to be younger and have lower incomes than repeat buyers. For this look at starter homes, let’s consider a two-person household with an income that is 80% of the area’s median income. The income level will vary across the state. For example, in Northern Virginia, this first-time buyer would have an income of about $66,000. In the Richmond area, their income would be about $58,000. And in southwestern Virginia, it would be about $38,000. What can these prospective buyers find that they can afford in their local markets?

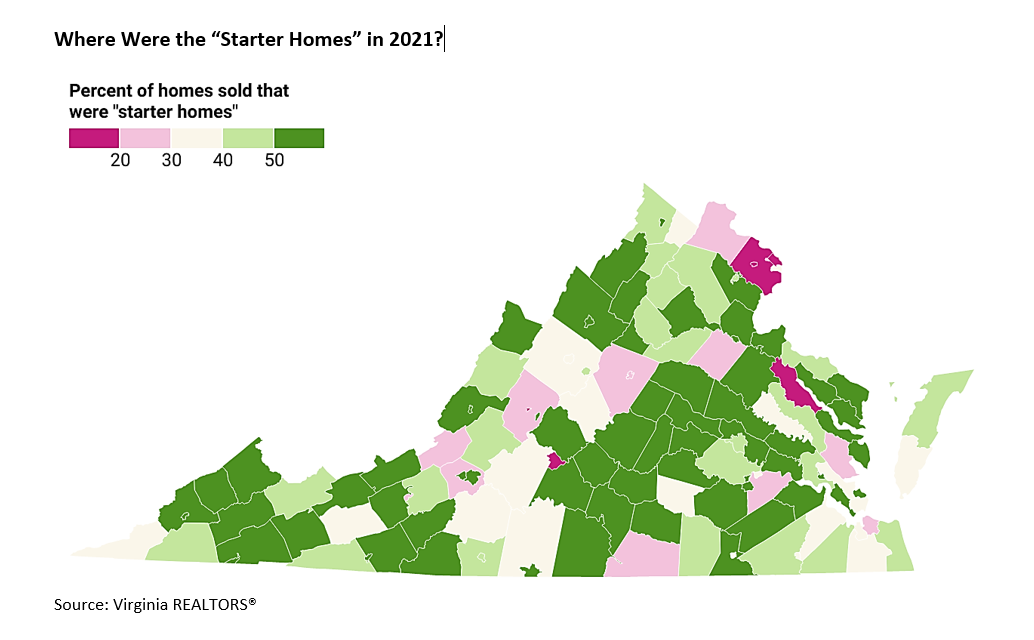

Well, it depends a lot on what part of the state they are in, but it has gotten more difficult to find a starter home over the past few years no matter where in Virginia you are. The most difficult market for first-time buyers? In 2021, that was Loudoun County, where only 9% of homes would be affordable to a household earning 80% of the area’s median income. Northern Virginia, overall, was the toughest market for first-time buyers. And even when there are homes in that first-time home buyer’s price rage, it is not going to be a single-family home, and probably not even a townhome, but rather a duplex or condominium.

The situation for first-time buyers has gotten increasingly difficult in many parts of Northern Virginia during the pandemic. Some of the further-out suburbs saw a surge of home-buyer interest over the past two years, which drove up prices considerably. For example, back in 2013, almost half of all homes sold in Stafford County would have been affordable to an individual or family with a “first-time home buyer” income. In 2021, that share had dropped to just 26%. In Culpeper County, the share of starter homes fell from 69% in 2013 to just 24% in 2021. The biggest drop, however, was in Madison County, where the “starter home” share dropped from 62% in 2013 to just 13% in 2021.

The Charlottesville market is also particularly challenging for first-time buyers. In 2021, only 26% of homes sold in Albemarle County would be classified as “starter homes”, affordable to a buyer with an income that was 80% of the area’s median income. The City of Charlottesville was not any easier—only 27% of homes sold last year were starter homes.

Areas of the state with the largest share of starter homes tend to be cities where there often has been long-term disinvestment and depressed property values, sometimes as a result of decades-long discrimination. For example, nearly all the homes in the cities of Petersburg and Hopewell would be classified as “starter homes”, meaning that an individual or family with an income of $58,000 could afford homes in the city. Nearly nine out of ten homes in the City of Colonial Heights would also be classified as “starter homes”.

As mortgage rates rise, first-time buyers in many markets are going to find it even harder to find that elusive “starter home”. Buyers need to have all their financing ready to go. And, they also need to be flexible in terms of location and/or home type. The “starter home” they imagined might look very different than the home they are actually able to buy, but the investment in homeownership will still be a good financial move over the long run.

You might also like…

Key Takeaways: November 2024 Virginia Home Sales Report

By Virginia REALTORS® - December 19, 2024

Key Takeaways Closed sales activity continues to ramp up compared to a year ago in Virginia’s housing market. There were 7,853 homes sold throughout the state in November.… Read More

Where Are Generations Moving Within Virginia?

By Abel Opoku-Adjei - December 17, 2024

Virginia’s diverse geography, robust economy, and rich history have attracted various people to the commonwealth. Due to Virginia’s many advantages, the state successfully retains a significant number of… Read More

Key Takeaways from NAR’s 2024 Profile of Home Buyers and Sellers

By Sejal Naik - December 9, 2024

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of recent home buyers and… Read More