Key Takeaways: October 2024 Virginia Home Sales Report

November 22, 2024 - Virginia REALTORS®

Welcome Virginia REALTORS®

By Lisa Sturtevant, PhD – Virginia REALTORS®

Virginia REALTORS® conducted a survey of property managers in the state, collecting responses from property management professionals in late March and early April. A total of 104 property managers responded, providing important insights into the state of the rental market and the property management industry in Virginia.

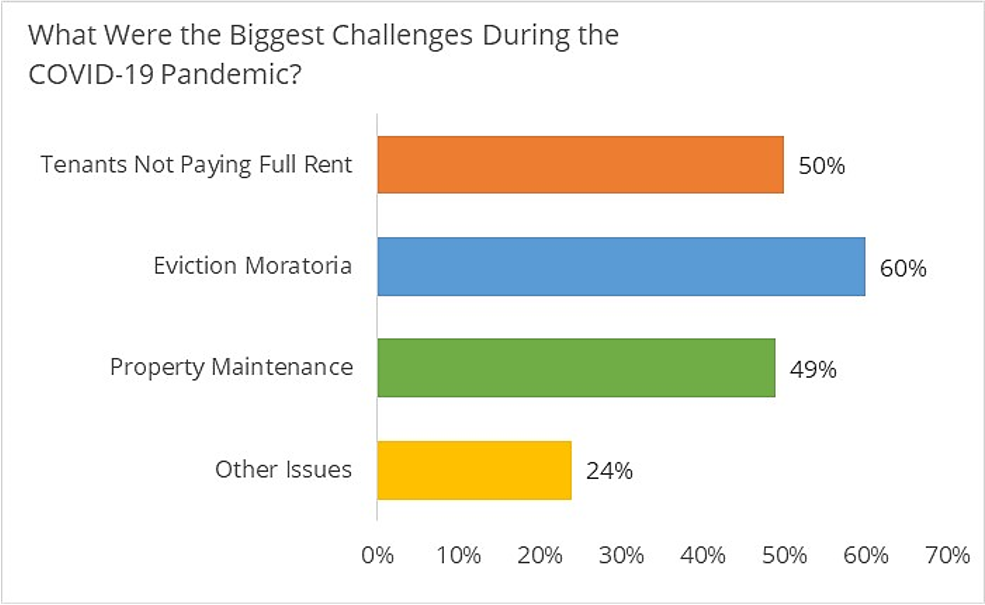

Challenges During the Pandemic

The vast majority of property managers reported that they faced challenges during the pandemic. The most common challenge reported by respondents was dealing with the eviction moratoria. Sixty percent of respondents said the eviction moratoria was one of their biggest challenges during the pandemic with significant burdens on property managers and landlords. As one respondent commented, “[I] would like to see the court system be more balanced and fair. [It is] unfair to owners that restriction on evictions.”

The second most common challenge reported by respondents was related to tenants not paying rent. Half of property managers surveyed reported that one of their biggest challenges during the pandemic was lack of rent payments. About 13% of respondents said that they collected less than half of the contract rent during the COVID-19 pandemic. Nearly two-thirds of property manages collected less than 100% but more than 50% of contract rent during that time.

During the COVID-19 pandemic, Virginia established the Rent Relief Program (RRP) to allow tenants and landlords to apply for rental assistance from the state. The goal was to help mitigate some of the income loss property owners experienced. About two-thirds of the Virginia property managers replying to the survey said they had received funds from the RRP.

State of the Rental Market

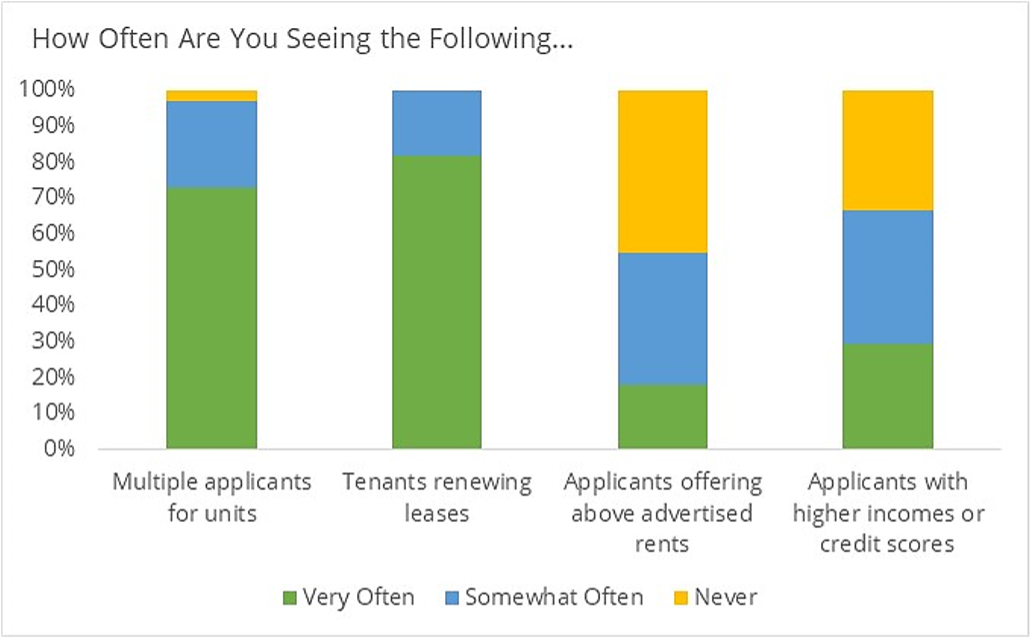

Property managers report very strong rental market conditions. Current tenants are remaining in their units. More than 80% of respondents report that they had tenants renewing leases very often. But there are many new renters, as well. Nearly all respondents stated that they are seeing multiple applications for units very often or somewhat often in their local markets.

Prospective renters are also somewhat better off financially than they have been. More than half of respondents said that applicants were offering above advertised rents very often or somewhat often. Furthermore, two-thirds of respondents found that applicants’ incomes and/or credit scores were very often or somewhat often higher than before COVID-19.

All but one respondent to the survey said that they think rents are going to rise in the future. In fact, half of all respondents report that they think rents were rise by 10% or more of the next three months. About a third say that rents will rise by less than 10% and another 17% think rents will be stable over that time.

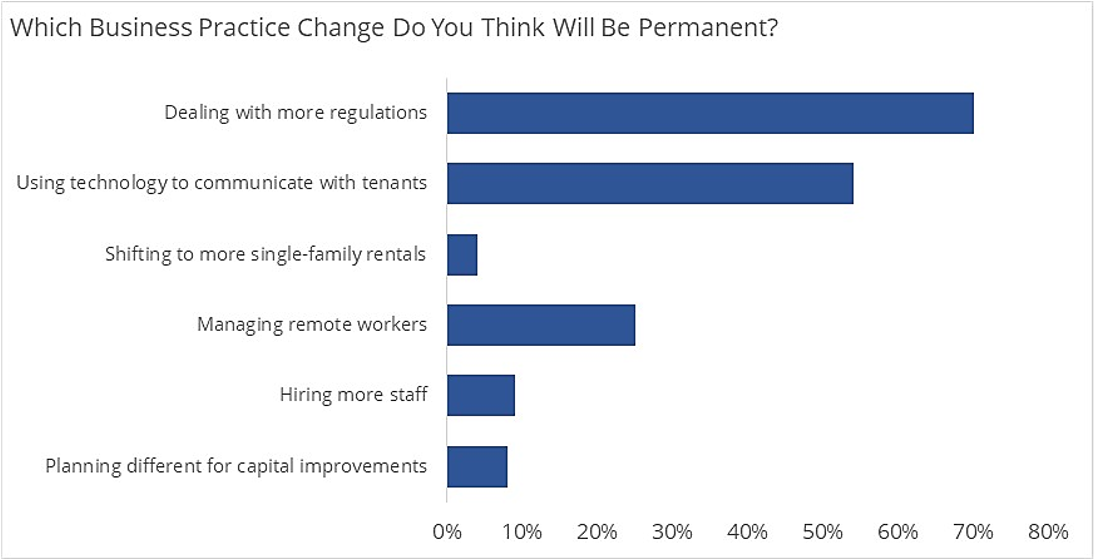

Changes in the Industry

About nine out of 10 respondents report that their business has changed as a result of the pandemic. The primary change reported was dealing with more regulations, followed by an increase in using technology to communicate with clients. Those two changes are likely to continue after the pandemic, according to respondents.

Seventy percent of respondents say that dealing with regulations will be a greater part of the property management industry even after the pandemic ends. Technology will also have a greater role in the property management business, with 54% of respondents believing that using more technology to communicate with tenants will be a permanent change. The role of technology will also be important for office operations. Twenty-five percent of respondents say that managing remote workers will be a permanent change in the industry.

Who Responded to the Survey?

All respondents to the survey were Virginia REALTORS® members with a primary business focus in property management. Nearly half of the property managers who responded to the survey manage 100 or more properties. Only 6% of respondents were small landlords, managing less than five properties. The remaining 45% of respondents report managing between five and 99 properties.

All respondents managed some single-family rental properties. Nearly 60% of respondents also manage individual apartments or condominiums. A quarter of respondents manage small apartment buildings, with fewer than 10 units.

November 22, 2024 - Virginia REALTORS®

November 14, 2024 - Dominique Fair

November 6, 2024 - Sejal Naik