How is Inflation Going to Impact the Housing Market?

November 8, 2021

We know home prices have been rising quickly over the past 12 months. But recently, it seems like everything—from automobiles to yoga pants—is getting more expensive. What is the relationship between inflation and the housing market in Virginia? And what does inflation mean for the demand for homeownership and the outlook for the residential real estate market?

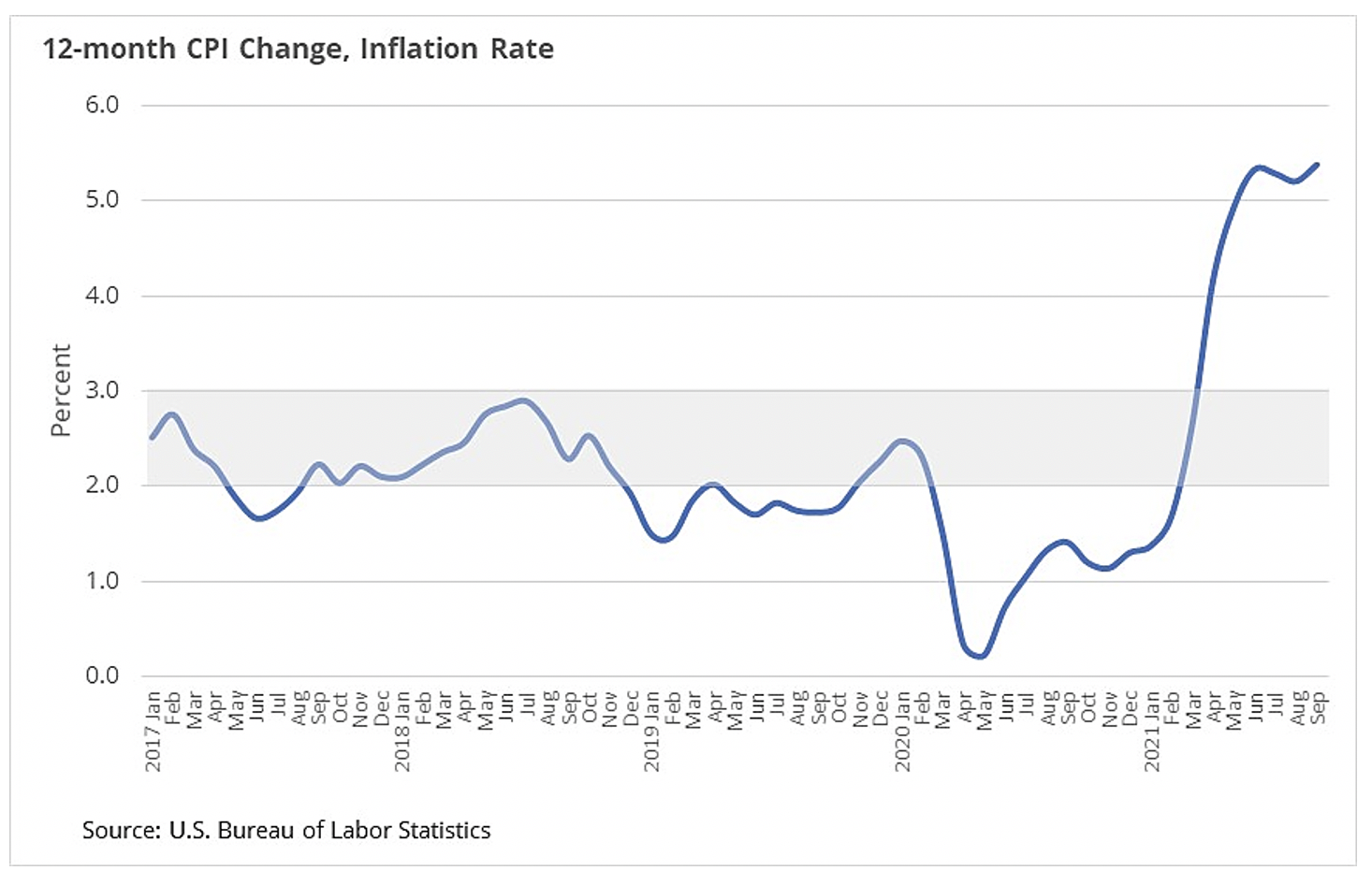

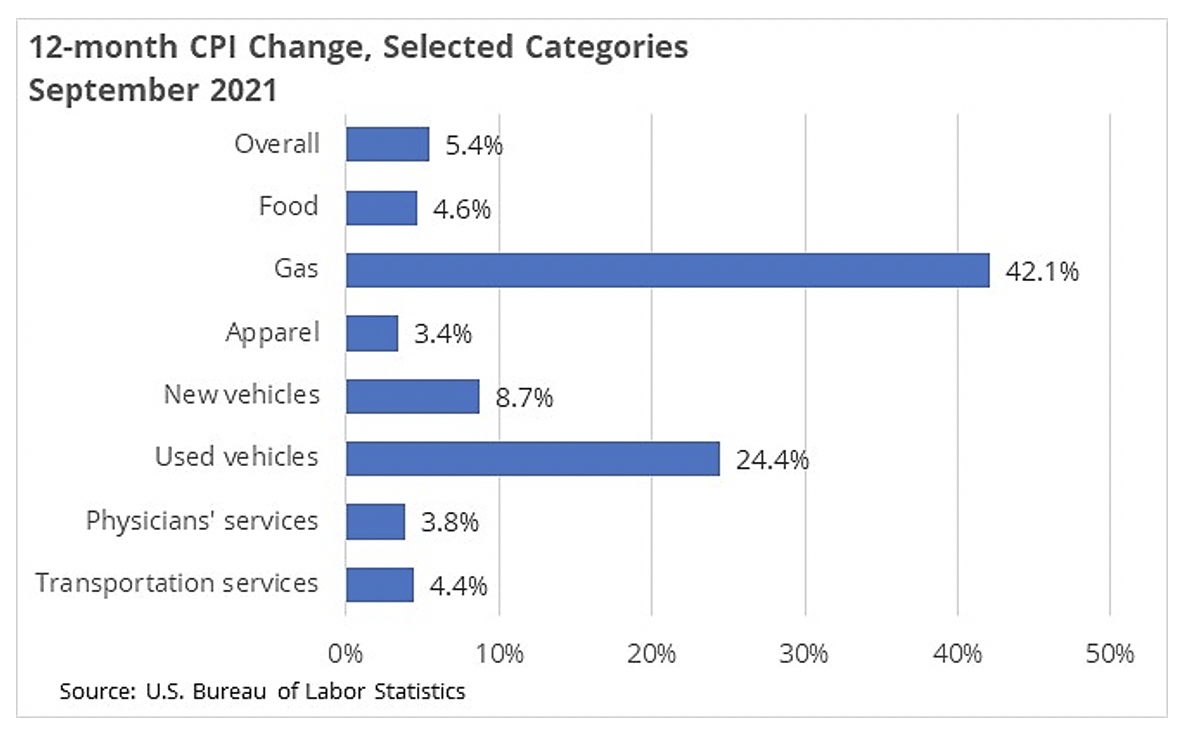

Inflation is measured as the year-over-year change in the Consumer Price Index (CPI). The CPI is an index measuring the prices of a whole range of goods and services purchased by individuals and families. In September, the U.S. Bureau of Labor Statistics reported that the CPI was up 5.4% year-over-year. Typically, the inflation rate hovers around 2% to 3%. However, since April, inflation has been running higher than 4%.

While prices are up across the board, there are two areas where costs have spiked: gas and automobiles. The price of gas is up 42.1% year-over-year in September. People in the market for a new car or truck will find prices up 8.7%, while used vehicle prices are 24.4% higher than a year ago.

Prices have been rising sharply since the spring, largely because of the surge in pent-up consumer demand coming at the same time when there are major challenges in getting goods to the shelves. Some of the supply chain issues will work themselves out as the COVID-19 pandemic eases, but it is still unclear how long these higher prices will be with us.

A quick note on how home prices and rents are included in the CPI measure. Housing costs are measured in the CPI in a way that dramatically understates how home prices are rising and the rents new renters are seeing in the market. Looking at specific data on home price appreciation and rent growth is a much better way to see how housing costs are rising.

The Effect of Inflation on the Housing Market

How inflation impacts housing market conditions is complicated and depends on a lot of things, including whether the run up in prices is a short-term trend or whether it becomes a long-term factor in the economy. However, there are at least three ways to think about how inflation could lead to weaker housing demand and contribute to an overall cooling in the housing market.

- Tighter Family Budgets

Families are watching their budgets more closely now, as they are paying more at the pump, at the grocery store, and nearly everywhere else. While wages are also rising, household incomes are not growing fast enough to offset higher prices. As a result, some people who may have been thinking about buying a home in the next few months will be putting those plans on hold.

- Rising Borrowing Costs

Inflation typically leads to higher mortgage rates, which makes it harder for prospective home buyers to finance a home purchase. In the very near-term (i.e., this fall), the prospect of rising mortgage rates could drive more people into the market to take advantage of rates that are still historically low. Longer-term, however, higher mortgage rates will cool buyer activity.

- Higher New Construction Costs

Prices are rising for a lot of the materials that go into building a new house, like concrete, bricks, drywall, stucco, appliances, doors, and windows, so inflation means that costs are up for homebuilders, too. Because of higher costs, builders will construct fewer entry-level properties and will build more higher-priced homes in order to recoup their higher costs. Therefore, options for first-time buyers and more moderate-income buyers may become even more limited than they are now.

The underlying economic and demographic fundamentals of the housing market remain strong. The housing market will continue to be robust in 2022, but the buyer frenzy of the past 18 months should ease. REALTORS® can prepare for the changing economic conditions by staying on top of the latest economic data and being a resource for clients about where the market is headed.

Please contact us if you need more information or would like Virginia REALTORS® Chief Economist to speak at your firm.

You might also like…

Key Takeaways from NAR’s 2024 Profile of Home Buyers and Sellers

By Sejal Naik - December 9, 2024

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of recent home buyers and… Read More

Virginia’s Labor Market: Growing Sectors and Their Impact on Real Estate

By Abel Opoku-Adjei - November 4, 2024

Virginia boasts one of the strongest labor forces in the country. As of September 2024, there are 4.25 million jobs in the state, according to the Bureau of… Read More

Buyer Broker Agreement: When Do I Need One?

By Santiago Montalvo - September 6, 2024

Let’s begin with when you do NOT need one. You sign a listing agreement with a now seller and someone calls you and asks you to show that… Read More