How Has the Pandemic Affected Landlords?

September 15, 2021

The Joint Center for Housing Studies (JCHS) recently released a report based on a survey of landlords in 10 cities across the U.S. on how rental property owners fared during the COVID-19 pandemic. (No cities in Virginia were surveyed.) While there has been a wide range of studies and media coverage on the impact of the pandemic on tenants, this report is among the very few that have specifically examined the challenges landlords have faced. In addition, while there has been regular reporting on rent collection among large, institutional property owners, there has been far less information on the financial health of small and mid-sized rental property owners.

Key Findings from the JCHS Report

1. Most Landlords Own Five or Fewer Units. According to the survey results for these 10 cities, about two-thirds of rental property owners own five or fewer units (small), 17% own between six and 19 units (mid-sized), and 17% own 20 or more units (large).

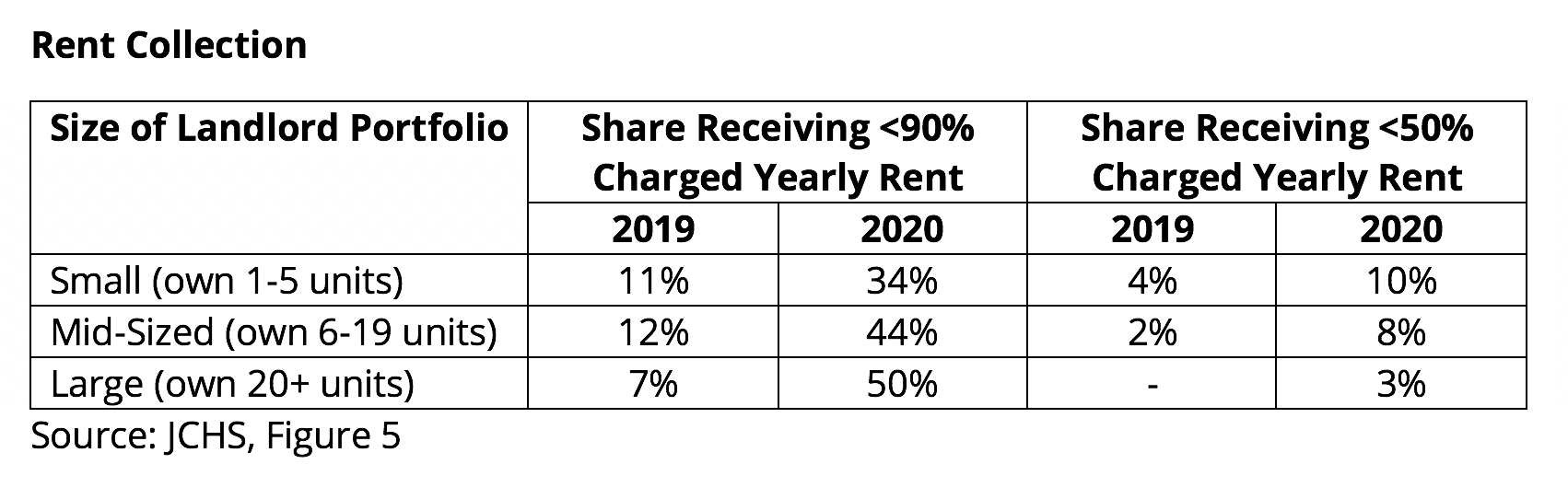

2. Landlords’ Rent Collection Declined Significantly in 2020. The National Multifamily Housing Council’s Rent Tracker has consistently shown that the vast majority of large, institutional property owners continued to collect full or partial rental payments in 2020. However, this JCHS research shows that many landlords—small, mid-sized, and large property owners—faced rent collection challenges last year.

According to this report, large property owners were most likely to see modest rent collection declines in 2020. But small and mid-sized property owners were more likely to face severe rent collection challenges during the pandemic. In fact, about one in ten small landlords and about one in 12 mid-sized landlords reported receiving less than half of their charged rent in 2020.

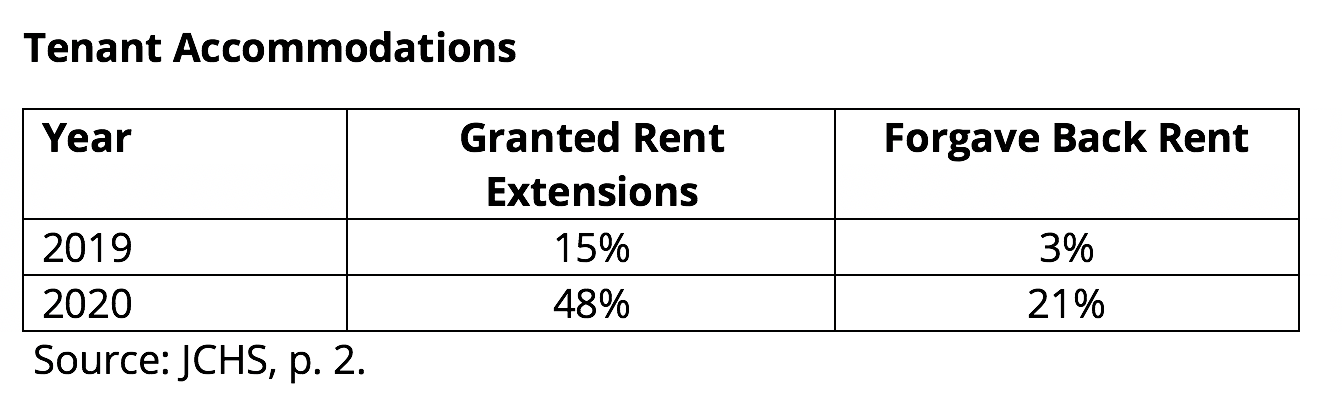

3. Many Landlords Worked with Tenants on Rent Issues in 2020. During the pandemic, many landlords made changes to their business practices to make accommodations for tenants by granting rent extensions, forgiving outstanding debt, and cutting rents. In 2020, about half of landlords reported offering rent extensions to at least one tenant and more than one-fifth forgave back rent.

Specific numbers on rent concessions were not reported by size of the landlord portfolio. However, the study’s findings suggest that small and mid-sized property owners were less likely than large property owners to have granted a rent extension or to have forgiven back rent in 2020, largely due to their inability to absorb a disruption to their more limited cash flows.

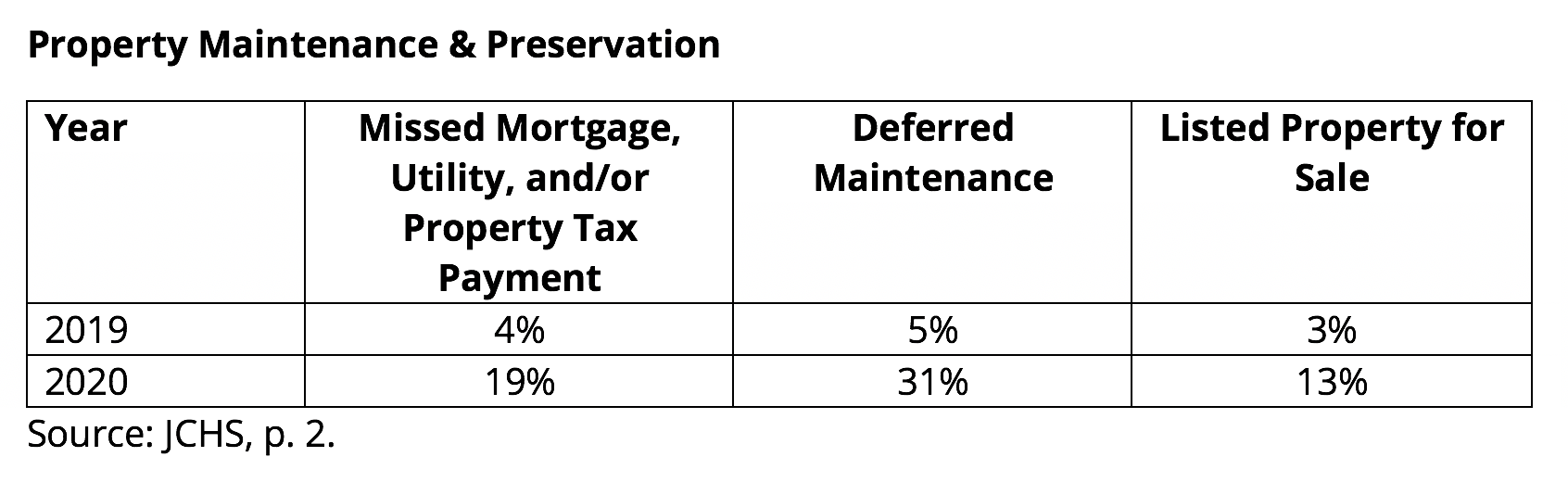

4. Lost Rent Led to Financial Hardships for Landlords. During the pandemic, a significant number of landlords had a hard time keeping up their properties, missed mortgage or utility payments and/or deferred maintenance. In addition, more landlords decided to sell their properties in 2020 than in 2019.

Similar to tenant concessions, specific numbers were not reported on property maintenance by size of landlord portfolio. Additional analysis in the study suggests that small and mid-sized landlords were somewhat less likely to have deferred maintenance or to have listed their property for sale compared to large property owners. No information is available on the likelihood of small and mid-sized property owners to have missed mortgage, utility and/or property tax payments.

Below is a key quote from the JCHS research report that highlights the particular challenges small and mid-sized landlords faced during the pandemic:

“Our findings show that small owners had the highest exposure to rental non-payment both prior to and during the pandemic, but mid-sized owners saw the largest increase in non-payment. These findings highlight the preexisting financial precarity of small property owners, as well as the tenuous financial position of mid-sized owners in 2020. Many small and medium-sized owners face challenges accessing credit to invest in their properties generally, which means that absent concerted efforts to bridge these credit gaps, owners of these properties will have difficulty restructuring their financing to ensure their property is viable.” (p. 23)

5. The Financial Challenges to Landlords Impacts Rental Affordability. The study authors conclude that the financial challenges faced by landlords during the pandemic will result in a reduction in the overall availability and affordability of the rental housing stock. They conclude:

“Combined, these findings highlight the strain the pandemic has placed on the housing stock, which has implications for the long-term viability and affordability of many of these units.” (p. 2)

For more information on Virginia’s rental market, check out our most recent Multifamily Market Report or contact us for more information.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

*Information as of 09/15/21

You might also like…

Key Takeaways: October 2024 Virginia Home Sales Report

By Virginia REALTORS® - November 22, 2024

Key Takeaways There was a surge in closed sales activity in October in Virginia’s housing market. The influx of sales was driven by a jump in pending sales… Read More

A Profile of Renters in Virginia Over the Last Decade

By Dominique Fair - November 14, 2024

Renters have experienced a series of ups and downs in the rental market over the last 10 years. The U.S. Census Bureau has released their American Community Survey… Read More

More People Moved to Virginia Than Out of the State Last Year

By Sejal Naik - November 6, 2024

Each year since 2005, the U.S. Census Bureau determines whether respondents of its surveys lived in the same residence a year ago. If people have moved, then the… Read More