Mortgage Buydowns: The Latest Insights & Trends

November 6, 2023

“Low interest rates on three; three, two, one, low interest rates!” Mortgage rates have risen since the FED implemented a new monetary policy in 2022, almost hitting 8%. As of November 2nd, the average 30-year fixed mortgage rate in the U.S. is 7.76%, the highest it’s been in over 20 years. High interest rates combined with low housing supply have been making the housing market undesirable for buyers and driving down sales activity across the nation. Many potential buyers have been overwhelmed by rising home prices and are put on the sidelines to continue renting. There is a tool called a 3-2-1 mortgage buydown that can incentivize potential home buyers to buy a home in high interest rate markets.

How Does A 3-2-1 Mortgage Buydown Work?

When potential home buyers are priced out of the market, they can try to get a 3-2-1 buydown mortgage. This type of mortgage reduces the loan interest for the first three years of the loan term. The initial rate will then be applied in the fourth year of the loan and continue for the life of the mortgage. In the first year, the loan is reduced by 3%, 2% in the second year, and 1% in the third year. For example, if a home buyer bought a home at a 7.76% mortgage rate in the first year of the loan, the rate would be 4.76%, then 5.76% the second year, and then 6.76% the third year.

The cost of a 3-2-1 buydown mortgage is the total amount that the buyer saves over the three-year period of lower rates. Usually, this type of mortgage is used by sellers or home builders to help ease the costs for buyers. Sometimes, a company would cover the buydown cost when relocating an employee to a new city to help with expenses. Buydown mortgages are only used for primary and secondary homes, not investment properties. The lender must still qualify the home buyer at full interest rate before implementing this tool.

Trends

Towards the second half of last year, the share of temporary mortgage buydowns surged when rates increased to over 6%. According to Freddie Mac, between June 2022 and June 2023, people who applied for a temporary buydown received interest rates that were 15 percentage points higher on average. Temporary buydowns were controlled amongst a few non-bank lenders in the last year. Between June 2022 and 2023, just 12 lenders managed 80% of all temporary buydowns in the nation, according to Freddie Mac.

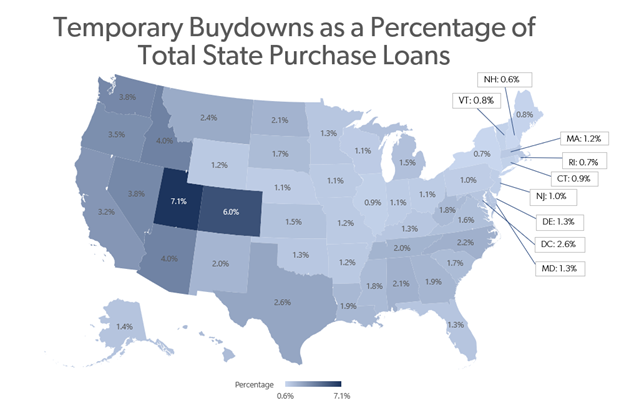

A study by Freddie Mac concluded that in Virginia, 1.6 percent of loans across the commonwealth were funded by temporary buydowns. This number is calculated by taking the number of temporary buydown loans divided by the total loans in the state.

Source: Freddie Mac

In recent months, temporary buydowns have been trending down compared to last year. This data can be used to analyze the willingness home buyers have to take high interest rates. 3-2-1 mortgage buydowns have become more common for financing newly built homes because home builders usually work together with mortgage companies to negotiate the price and rates. Potential home buyers who want to use this financial option must understand that in the fourth year the mortgage will go up to its original rate and evaluate their finances to make sure they can afford it when the time comes.

You might also like…

Key Takeaways: December 2025 Virginia Home Sales Report

By Virginia REALTORS® - January 26, 2026

Key Takeaways 2025 home sales activity ended on a strong note, in what had otherwise been a sluggish year in Virginia’s housing market. There were 8,482 homes sold… Read More

3 Predictions for Virginia’s Housing Market in 2026

By Sejal Naik - January 21, 2026

2025 was a year of improving inventory conditions, a downward trend in mortgage rates in the latter part of the year, increasing prices, and a modest growth in… Read More

Three Multifamily Market Trends from the Fourth Quarter of 2025

By Sejal Naik - January 21, 2026

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key insights… Read More