How Will Student Loans Impact First-Time Home Buyers?

October 26, 2023

Student loans are back. Well technically, they never went away. What does this mean for first-time home buyers throughout the commonwealth? As of October 2023, the forbearance on student loans initiated during the coronavirus pandemic has been lifted, and more than 28 million borrowers will have to start making repayments to avoid accruing interest and negative dings toward their credit. According to the U.S. Department of Education, the average federal student loan debt for Americans is $37,338, making the total student debt across the nation to edge over $1.6 trillion. The Biden Administration had promised to cancel at least $10,000 of student loan debt, but the Supreme Court rejected his program. At $39,330.39, Virginia has one of the highest average student loan balances compared to other states.

Student loans can be a major obstacle for those trying to buy a house. One of the main factors mortgage lenders observe is a person’s DTI (debt-to-income) ratio. Lenders use this tool because it indicates if a borrower is at risk of defaulting on the loan. The less debt a person has, the more likely they’ll be approved for a bigger loan. DTI ratio measures all the monthly debt payments a person makes, like personal loans, credit cards, and auto loans, divided by your monthly gross income.

Defaulting on student loans can have a negative impact on a person’s credit score. Mortgage lenders rely on an applicant’s credit score before issuing a loan. Making monthly student loan payments on time will boost your credit score, but defaulting on the loan will bring your score down. This can be an issue for many people, depending on their financial situation.

One of the most significant impacts student loans have on potential buyers is the ability to save up for housing costs and down payments. Most of the time, buyers must put a down payment between 3.5% to 20% for their mortgage, which can cost thousands of dollars. For example, in Virginia, the median sales price for a home in September was $380,000. This means a 3.5% down payment would be $13,300, a 10% down payment would be $38,000, and a 20% down payment would be $76,000. This could take a lengthy period of time to save for borrowers with student loan repayments.

The dream of becoming a homeowner is becoming more unaffordable as time goes on. According to The Motley Fool, 57% of Americans would rather use the student loan repayment money for other financial goals. About 19% of borrowers between the ages of 18 and 29 would use it to save up for a home, meaning most of them could be potential first-time home buyers.

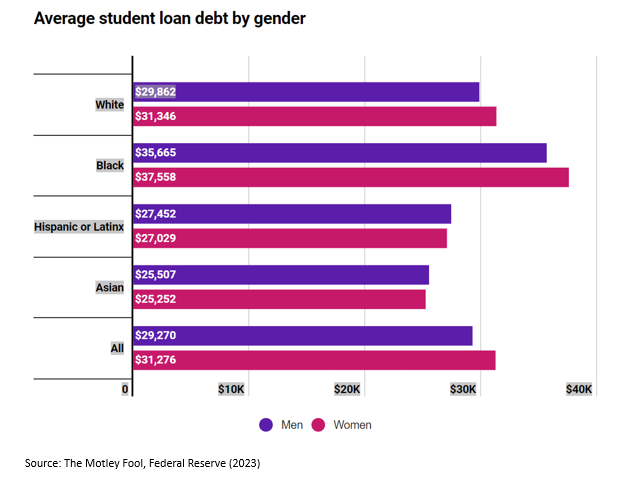

African Americans have the highest student loan debt compared to other races in the United States according to data from the Federal Reserve. A Motley survey found that 11% of Black Americans would instead use their money from student loan repayments to save up for a home.

Even though student loan repayments are back, there are many resources out there that can help potential home buyers who may feel overwhelmed with buying a home and keeping up repayments. There are national and local down payment assistance programs that will give grants to help first-time home buyers and could potentially cover all or part of your down payment. VA loans have options for current and former eligible military members that don’t require any down payments for a mortgage loan. USDA loans also have zero-down options for qualified applicants looking to buy a home in a rural area. It’s essential to take a close look at your financial situation before taking a leap into purchasing a home. As worrying as student loan repayments may seem, it doesn’t mean homeownership is out of reach. There are also programs such as the income-driven repayment plan or an extended repayment plan that can help reduce how much you pay each month if eligible.

You might also like…

Key Multifamily Market Trends from the Fourth Quarter of 2024

By Sejal Naik - January 14, 2025

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Three Predictions for Virginia’s Housing Market in 2025

By Ryan Price - January 8, 2025

Virginia’s housing market in 2024 was marked by a slight uptick from the slowdown in 2023. Home sales activity increased modestly despite high mortgage rates. The additional sales… Read More

Are HOA Communities Becoming More Popular?

By Abel Opoku-Adjei - January 6, 2025

Homeowner association communities (HOAs) have been gaining popularity in recent years, and there’s no sign that this trend is slowing down. In 2024, there were approximately 369,000… Read More