The Importance of Home Equity and Trends in Virginia

July 28, 2023

Homeownership is one of the best ways to build long-term wealth, as homes are considered an appreciating asset. We will explore different ways your clients can access their equity and we’ll take a look at Virginia’s home equity trends.

Equity is the value of an investor’s proprietorship of an asset. Payments made towards a mortgage allow a homeowner to gain more equity on their home as the value of the home increases over time. Many refer to this as a “forced savings account,” but it yields much higher returns. Apart from paying off debt, another way to increase home equity is by improving and maintaining the home. For example, redoing floors, upgrading the kitchen and bathrooms, or other projects can help increase the value of your client’s property. As equity is built up over time, your client may be able to access their equity without selling the property.

A HELOC vs. Home Equity Loan

Instead of selling your home, you can borrow against your home equity up to 85% of your home’s combined loan-to-value (CLTV ratio), which varies by lender. This is also referred to as a second mortgage. A HELOC allows you to borrow adjustable amounts rather than taking a lump sum all at once. This method generally has variable interest rates, separate draw periods, and repayment periods. A home equity loan gives borrowers a large lump-sum payment that they pay back with fixed installments over a given time.

Cash-Out Refinance

Another way to borrow against your home equity is through a cash-out refinance. The difference with a cash-out refinance is that it replaces your primary mortgage instead of taking out a second mortgage with a HELOC or home equity loan. You will receive money for your home’s equity but have one monthly mortgage payment with a new locked-in interest rate.

Trends In Virginia

According to the National Association of REALTORS® (NAR), equity growth in Virginia outpaced the nation as a whole in some of our major markets in the first quarter of 2023. Those who acquired a home in Virginia in the first quarter of last year gained nearly double equity growth compared to the rest of the nation, according to the NAR local market report.

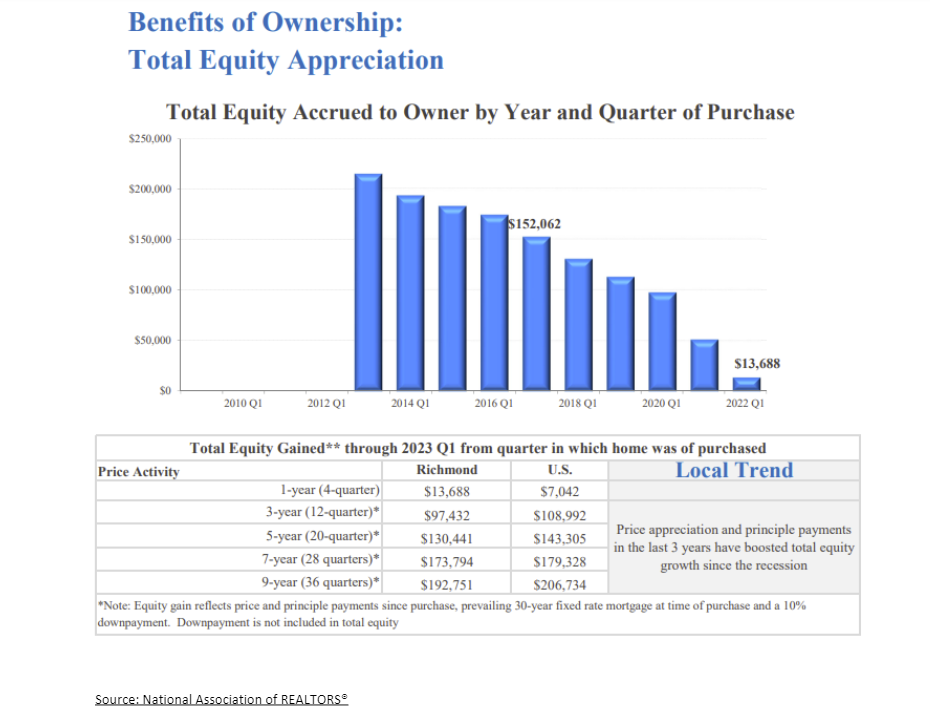

Richmond MSA

In Richmond MSA, homes have appreciated strongly within the last nine years. On average since quarter one of 2022, homes have appreciated by $13,688 within one year, which is $6,646 higher than the national average. Within nine years, homeowners in the Richmond metro area gained about $193,000 in equity.

Virginia Beach – Norfolk – Newport News MSA

There has been strong price growth in the Virginia Beach-Norfolk-Newport News MSA within the last nine years. According to NAR, home prices rose by 8% in the metro area during the first quarter from a year ago, outpacing the nation by 7.7%. Due to price appreciation and principal payments, total equity gained rose sharply from quarter one of 2022. Homes gained an average of $28,115 in equity within one year, which reflects the highest gain compared to the Richmond Metro and the Washington Metro in the last four quarters.

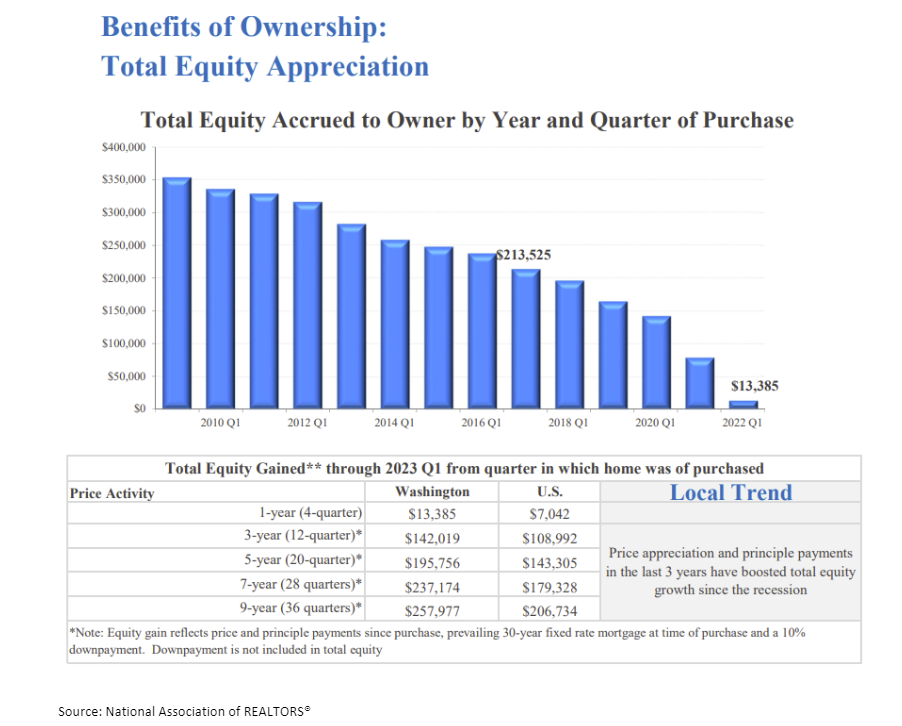

Washington-Arlington-Alexandria MSA

In the Washington-Arlington-Alexandria Metro, home prices continue to grow but at a slower rate. Home prices appreciated by 0.8% in the first quarter from a year ago, outpacing the nation by 0.5%, according to the NAR report. Homeowners throughout the metro area have gained $195,756 in equity in the last five years of ownership, about $52,000 more than the national average.

Homeownership can be the beginning of generational wealth for many families. A home is considered to be an appreciating asset, so in most cases it will yield a positive rate of return. Be a resource to your clients by giving them your insight on home equity. Tapping into this equity can bring great financial leverage to homeowners.

Are you keen on keeping up with Virginia’s housing trends? Be sure to visit the Data Page where we update housing and economic trends in Virginia.

You might also like…

Key Takeaways from NAR’s 2024 Profile of Home Buyers and Sellers

By Sejal Naik - December 9, 2024

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of recent home buyers and… Read More

Key Takeaways: October 2024 Virginia Home Sales Report

By Virginia REALTORS® - November 22, 2024

Key Takeaways There was a surge in closed sales activity in October in Virginia’s housing market. The influx of sales was driven by a jump in pending sales… Read More

A Profile of Renters in Virginia Over the Last Decade

By Dominique Fair - November 14, 2024

Renters have experienced a series of ups and downs in the rental market over the last 10 years. The U.S. Census Bureau has released their American Community Survey… Read More