Multifamily Housing & New Construction Activity

March 14, 2023

Low inventory continues to be a persistent issue in today’s housing market. In the current market, understanding the trends in new construction activity could be beneficial to determine if there is potential respite in sight for housing supply. As reported by the U.S. Census Bureau, overall housing starts in the country were 4.5% lower in January 2023 compared to December 2022 and were 21.4% lower than the year before. Total building permits had a slight uptick of 0.1% compared to the prior month but plunged by 27.3% from the previously reported numbers in January 2022. All this amounts to weakened new construction activity at the beginning of the new year.

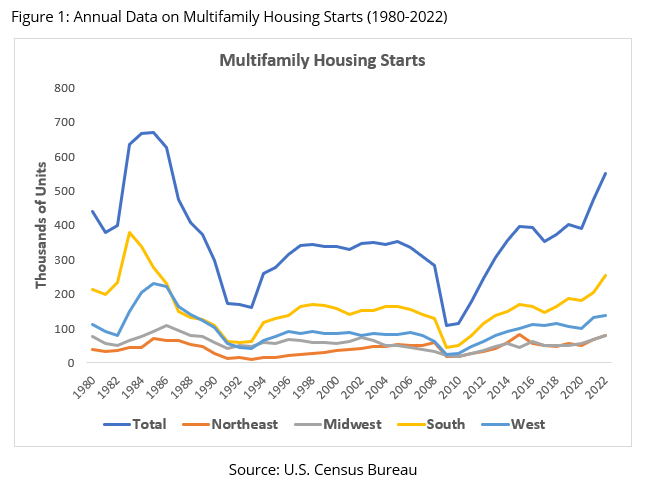

However, even though the overall new construction activity looks bleak, a deeper dive into the multifamily housing construction paints a slightly brighter picture. In 2022, multifamily starts, specifically the construction of buildings with five units or more, were at their highest annual levels since the 1980s. At the beginning of 2023, construction of multifamily housing units fell by 5.4% compared to the previous month, where all three other regions in the country except for the West experienced a decline in new construction.

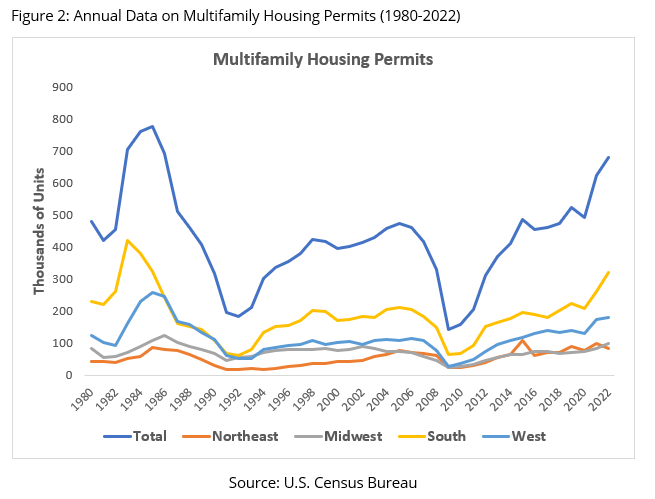

In January 2023, building permits for structures with five units or more went up slightly by 0.5% from December 2022, while those for structures with two to four units increased by 26.1% over the same period. This uptick can be attributed mostly to increased multifamily activity in the South and Midwest. This impending influx of multifamily housing units is likely to provide some relief to the rental market participants who have been met with increased rents and higher associated costs. Moreover, multifamily housing numbers tend to reflect a long-term trend and positive signs in this sector early in the year most likely foreshadow the dominance of the multifamily housing activity throughout the year.

Supply, albeit improving with regards to multifamily housing, is just one side of the housing market equation. Demand remains dampened due to high mortgage rates and increasing inflation. The way in which factors such as rising prices, home-buyer sentiment, and home builder outlook affect both supply and demand in the coming months will determine how this year will be for overall housing market activity.

For more information on demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: November 2024 Virginia Home Sales Report

By Virginia REALTORS® - December 19, 2024

Key Takeaways Closed sales activity continues to ramp up compared to a year ago in Virginia’s housing market. There were 7,853 homes sold throughout the state in November.… Read More

Where Are Generations Moving Within Virginia?

By Abel Opoku-Adjei - December 17, 2024

Virginia’s diverse geography, robust economy, and rich history have attracted various people to the commonwealth. Due to Virginia’s many advantages, the state successfully retains a significant number of… Read More

Key Takeaways from NAR’s 2024 Profile of Home Buyers and Sellers

By Sejal Naik - December 9, 2024

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of recent home buyers and… Read More