The History of Black Homeownership Rates

February 16, 2023

Homeownership is one of the primary ways to build wealth in this county, but for Black Americans that has been a challenging goal to achieve. As we celebrate Black History Month, it’s important to understand and examine the barriers to Black homeownership so that as a community we can use our resources to help expand homeownership for all.

The Great Depression

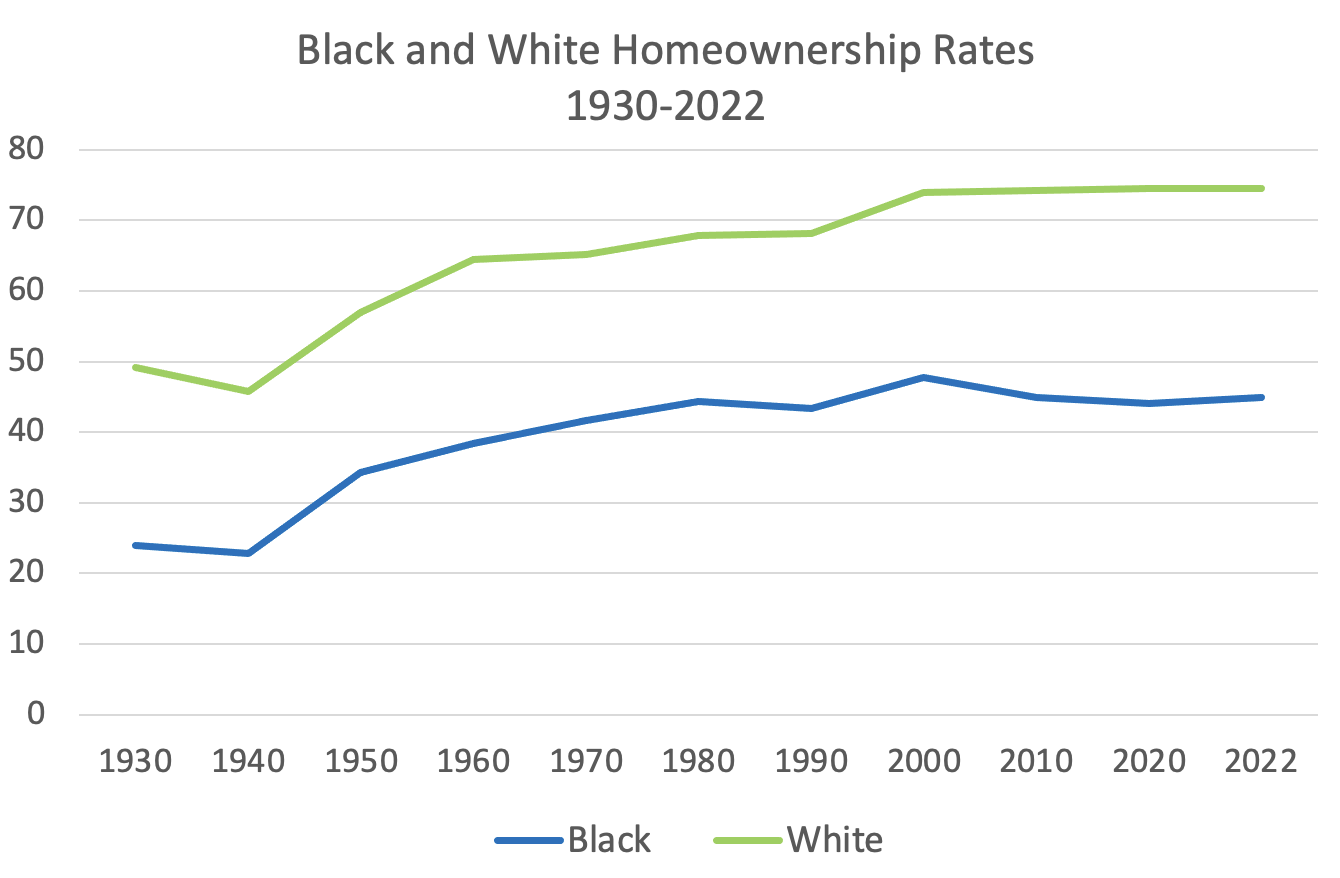

After the Great Depression, several programs were rolled out by President Roosevelt in order to bolster homeownership and housing construction. As a result of these programs, homeownership became more affordable for many households, but Black Americans did not benefit in the same way White Americans did. Many Black people experienced discriminatory housing practices such as redlining, which denied them home loans based on the areas they lived in that were considered “high risk” by lenders. These housing practices coupled with Jim Crow laws furthered the homeownership rate gap between Black and White. By 1940, 45.6% of White households owned their home, while 22.8% of Black households owned theirs.

The Fair Housing Act

Black homeownership saw its biggest growth from 1940-1960, going from 22.8% to 38% due to a booming economy after World War II, which saw all homeownership rates for demographics grow. In 1968, the Fair Housing Act prohibited redlining and discrimination in housing based on race, sex, religion and national origin. After the act was passed, the homeownership gap between Black and White home owners continued to grow with 65.2% of White people owning their home versus 41.6% of Black households in 1970. The divide between Black and White homeownership would continue to widen and by 1990, White homeownership rates stood at 69.1% while Black homeownership rates reached 43.9%.

Housing Boom to The Great Recession

By 2004, Black homeownership reached its highest rate at 49% with many Black owners taking advantage of the housing boom. As homeownership rates increased so did the use of subprime loans and predatory lending practices that were disproportionally directed at Black and Hispanic borrowers. In 2006, 52.9% of Black borrowers assumed a subprime mortgage compared to 47.3% of Hispanic borrowers and 26.1% of White borrowers.” When the Great Recession hit, a wave of job losses and foreclosures due to high interest loans contributed greatly to the loss of wealth for all Americans but was higher among Black and Hispanic people. From 2005 to 2009, the median wealth fell by 53% in Black households and 66% in Hispanic households with White households experiencing a 16% loss. The effects of the housing downturn in 2008 continued to effect Black homeownership into 2019, falling to 40.6%, the lowest rate since the signing of the Fair Housing Act in 1968.

COVID-19 to Present

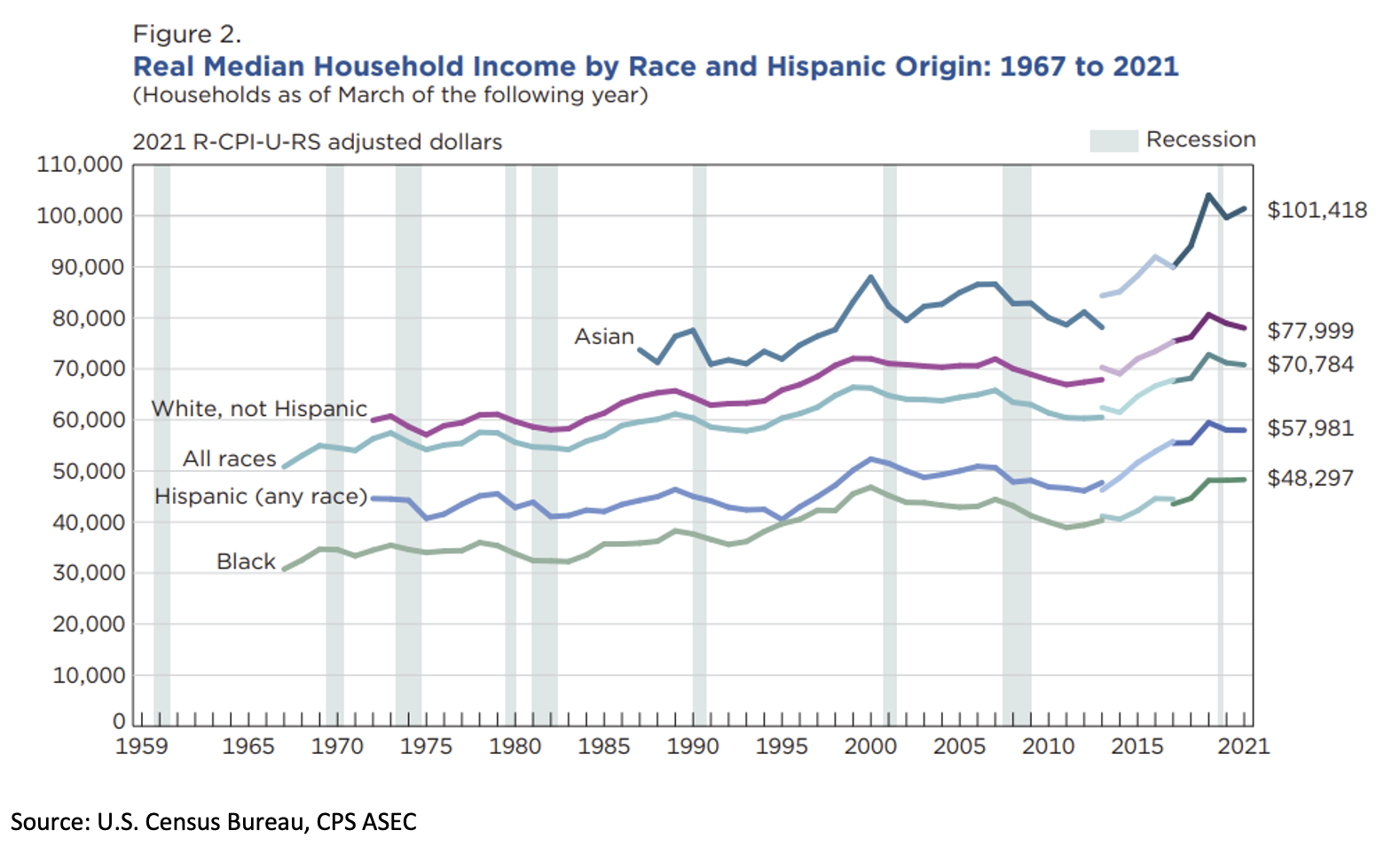

For Black buyers, the homeownership rate increased to 47.0% by the end of the second quarter in 2020, six percentage points more compared to the second quarter of 2019. As the pandemic continued, home prices and interest rates began to rise creating an affordability issue for many, especially potential Black homebuyers. The U.S. Census Bureau reported that in 2021, Black households had a median income of $48,297, compared to White households with $77,999 and Asian households with $101,418. The lack of income not only contributed to higher loan denial rates but also lead to higher costing loans, with 14% of Black borrowers receiving a high-cost loan compared to 5% of White borrowers. By the end of the fourth quarter in 2022, the Black homeownership rate was 44.9%—slightly higher than it was at the end of 2019, but more than 29 percentage points behind White homeownership rates.

Black people have persevered through the many obstacles placed in their path to homeownership and although progress has been made, there is still work to be done. Increasing homeownership rates for Black people not only allows them to achieve the American dream, it also creates economic stability and an opportunity for generational wealth. In their 2022 State of Housing in Black America (SHIBA) report, NAREB suggests ways to make homeownership more accessible to Black Americans. NAREB has also created an initiative called Two Million New Black Homeowners Program that aims to close the racial gap in homeownership through community outreach and advocacy. The National Association of REALTORS® has released Fairhaven, a platform used to train agents on how to identify and handle situations in which they are confronted with discriminatory practices.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Key Takeaways: January 2026 Virginia Home Sales Report

By Virginia REALTORS® - February 23, 2026

Key Takeaways There was a modest uptick in sales activity statewide to start the year. There were 5,881 home sales in Virginia in January 2026, outpacing last January… Read More

Building Permit Trends and Impacts on Housing

By Abel Opoku-Adjei - February 20, 2026

Before housing construction begins, a project must go through a complex permitting process in the local area. While permits may seem like a routine step, builders nationwide have raised concerns about how complex and time-consuming this process is. Delay… Read More

Migration to Virginia: More People Moving In

By Sejal Naik - February 18, 2026

Each year since 2005, the U.S. Census Bureau determines whether respondents of its surveys lived in the same residence a year ago. If people have moved, then the… Read More