Senior Population Trends and What They Mean for the Housing Market

November 22, 2021

Seniors continue to represent a larger segment of the overall population. In many parts of the world, including here in the U.S., life expectancy is trending longer, and at the same time, fertility rates are declining. These factors are creating a larger proportion of seniors in our communities. Another major factor driving this shift is that the baby boomers, which are one of the largest generations in the U.S., continue to age into this demographic. By 2030, the youngest baby boomers in our country will reach age 65.

Nationwide, the senior population is expected to nearly double by 2060 and will represent a quarter of the entire population. Here in Virginia, there were more than 1.3 million seniors 65 and older in 2019, which is 16% of the state’s total population. This is up from 12% in 2010.

We know this demographic shift is underway now and will continue, so what are some of the ways it could impact the housing market?

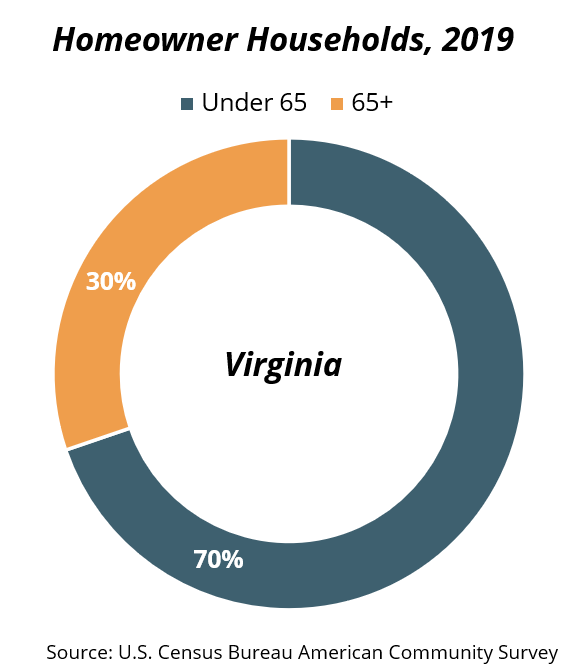

Seniors play a large role in the housing market, particularly within the ownership market. Nearly one out of every three homeowners in the Virginia are 65 and older.

Data also indicate the homeownership rate in the state peaks between age 75 and 84. Since seniors are more likely to own their homes than younger adults, and the fact that the senior population is expected to swell in the coming decades, the housing trends and preferences among this segment of the market will be an increasingly important factor in housing markets across the commonwealth and beyond.

Housing for seniors will be in high demand, whether it be for-sales homes or rental options. For those seniors that currently own their home and are looking to move, either to buy another home, or opt for a rental home, if there are options available for senior sellers, it will also have a positive impact on the supply challenges facing other segments of the market, such as move-up buyers because it will facilitate more churn of homes coming on the market.

What are some of the most common housing preferences among senior buyers?

Each year, the National Association of REALTORS® conducts a survey to track generational trends in the housing market. The results of the survey provide key insights into what decisions are driving the homeownership market, and importantly, what the key preferences are for each generation in the market. This is particularly useful for understanding the patterns of senior homeowners. Some key takeaways from the latest survey results include the following:

- Housing specifically designed for seniors is growing in popularity.

Senior housing includes any type of home that is geared towards seniors, ranging from homes in 55 and older independent living communities, to condos in senior-care facilities, and really any type of housing all along the care-spectrum. The survey found that nearly half of home buyers over the age of 65 bought senior-related housing. The most common type of senior housing purchased were single-family detached homes. It will be important for communities to facilitate the production of this type of housing stock in the coming years through comprehensive planning and zoning related initiatives/changes.

2. Most seniors looking to buy want to be closer to family/friends and/or to downsize their home.

The survey results suggest seniors are entering the housing market to be closer to loved ones and also downsize into a smaller, more manageable home. This indicates that the market demand for smaller, single-level style homes, will become much higher in the coming years. In many markets, this type of housing stock is very scarce. Smaller homes tend to be priced lower than larger homes, so in many cases seniors and price-sensitive first-time homebuyers are likely competing for the same homes. Increasing the supply of this type of housing, either through production or renovation of existing stock, will be critical to provide housing options all along the age spectrum.

3. Multigenerational living is becoming more common; flexibility, assistance, and facilitation of home modifications will be key to meeting this demand.

A multigenerational household is one where two or more generations live under the same roof. There are several varieties of this, one being adult children living with their aging parents. According to the survey, the key drivers for younger and middle-aged homebuyers that purchased a multigenerational home were for health/caretaking of aging parents, spending more time with aging parents, and for cost savings (pooling resources together between the multiple generations). An increase in multigenerational living will likely drive-up demand for larger homes that have enough space and layouts that are conducive for multiple generations. This could mean bedrooms on the ground floor, accessory dwelling units (“granny-flats”), or in-home apartment/unit layouts among others. This type of housing is not as common in the current housing stock, so renovations and modifications to existing homes will be critical to meet the needs of families that opt for multigenerational living. It will be important for communities to look for ways to facilitate these types of renovations, whether it be income-based grant programs, flexible zoning requirements/overlay options, streamlined permitting, or design resources on best-practices.

For more information on demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other economic insights blogs and our data page.

You might also like…

Key Multifamily Market Trends from the Fourth Quarter of 2024

By Sejal Naik - January 14, 2025

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Three Predictions for Virginia’s Housing Market in 2025

By Ryan Price - January 8, 2025

Virginia’s housing market in 2024 was marked by a slight uptick from the slowdown in 2023. Home sales activity increased modestly despite high mortgage rates. The additional sales… Read More

Are HOA Communities Becoming More Popular?

By Abel Opoku-Adjei - January 6, 2025

Homeowner association communities (HOAs) have been gaining popularity in recent years, and there’s no sign that this trend is slowing down. In 2024, there were approximately 369,000… Read More