Takeaways From the JCHS 2024 State of the Nation’s Housing

July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners and renters. Let’s look at some of the key takeaways.

Buyers and Renters Grapple with Affordability

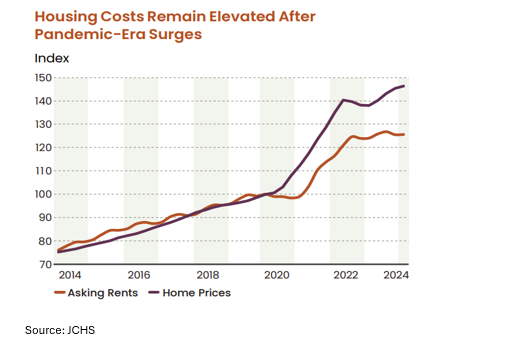

Affordability challenges continue to affect the current market with home prices up 47% nationwide since the pandemic, and rates continuing to edge closer to 7%. The combination of these factors has led to higher mortgage payments, with a buyer needing to make $119,800 to afford the median mortgage payment of $2,201. For renters, only one in seven can afford mortgage payments at this level. According to the JCHS 1 in 4 households are now worriedly feeling the financial strain of higher housing costs. Many first-time buyers, those 35 years and under, are being priced out of the market with loan originations falling by 17% and homeownership rates dropping 0.4 percentage points. Across all age groups, homeownership went up 0.1 percentage point in 2023, the lowest increase since 2016.

On the rental market side, rent growth has slowed to 0.2% but is still 26% higher than it was in the beginning of 2020. With rent outpacing income levels, half of all renters (22.4 million) are now cost burdened while the number of severely cost burdened, those spending more than 50% of their income on housing, rose to a high of 12.1 million.

Tight Supply Leads to New Construction

In 2023 there were 4.1 million existing home sales, down 19% from the previous year and the lowest sale rate in almost 30 years. High home prices and rates have contributed to the lack of supply with many buyers unwilling to give up the lower interest rates on their current home. The limited existing inventory on the market has led to a rise in the demand for new single-family construction with housing starts averaging 1.06 million in the first quarter of 2024. Builders are offering rate buydowns and building smaller homes to incentivize buyers while also offsetting costs. The supply of newly built multifamily buildings has also been on the rise with 487,000 units added over the last year, the highest completion level since May of 1988. Although we are seeing supply increase in both markets, there are challenges as insurance premiums and operating costs increase and lending conditions tighten due to higher interest rates.

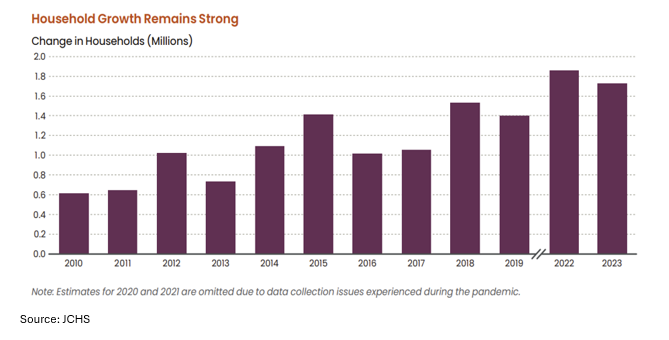

Younger, More Diverse Groups Heading Households

Even with the rise in housing costs, there were 1.7 million households added last year bringing the total number of households to 130.3 million in the U.S. Most of the growth in households has come from the younger generations, with Generation Z creating 8.1 million households between 2017 and 2022 and millennials adding 6.9 million households. Gen Z and millennials are more racially diverse compared to previous generations with nearly 80% of household growth attributed to households of color in the last five years. A third of these households of color are headed by immigrants who are impacting population growth, going from less than 500,000 in 2019 to 3.3 million in 2023.

The cost of housing remains an ongoing issue for buyers and renters, but the market is showing some signs of improvement. Rent growth has decreased as more apartments hit the market while the inventory of existing homes rose to 1.28 million units at the end of May 2024, an 18.5% jump from a year ago.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Building Permit Trends and Impacts on Housing

By Abel Opoku-Adjei - February 20, 2026

Before housing construction begins, a project must go through a complex permitting process in the local area. While permits may seem like a routine step, builders nationwide have raised concerns about how complex and time-consuming this process is. Delay… Read More

Migration to Virginia: More People Moving In

By Sejal Naik - February 18, 2026

Each year since 2005, the U.S. Census Bureau determines whether respondents of its surveys lived in the same residence a year ago. If people have moved, then the… Read More

Whose House? A Look at Household Types in Virginia

By Dominique Fair - February 2, 2026

The traditional structure of an American household is alive and well but has shifted over the past 50 years to make way for more non-traditional ones. Virginia at… Read More