Mortgage Rates Edge Lower, Bringing Prospective Buyers Back into the Market

January 5, 2026

This year, Virginia’s housing market demonstrated signs of slowing compared to the rapid activity during the pandemic years, although overall activity stayed consistent. Both pending and closed sales showed ongoing buyer interest influenced by broader economic and seasonal factors. Among the many housing indicators, pending home sales are particularly significant, providing timely insights into buyer behavior and the short-term outlook for the market. Pending sales refers to homes that are under contract but haven’t closed yet. Monitoring these figures helps forecast future market activity and often indicates changes in momentum weeks or months before they show up in closed sales data. It’s also important to recognize that pending sales are influenced by seasonal trends, with activity usually declining in late fall and winter and picking up during spring and summer.

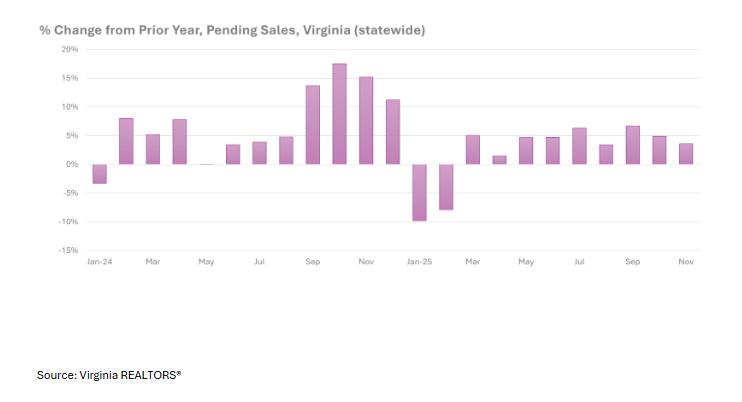

Despite these seasonal headwinds, pending sales trends in late 2025 have been encouraging. Nationwide, pending sales increased by 2.6% compared to last November and grew by 3.3% from October to November. After adjusting for seasonal factors, the trend suggests stronger homebuyer activity. Virginia also mirrored this trend. There were 7,107 pending transactions recorded in November, a 3.6% increase compared to the year before. Year-to-date activity in the state has been 2.5% higher than last year.

Pending sales have increased year-over-year for a ninth month in a row in Virginia. Although affordability remains a challenge for many, buyers who are financially able to move forward continue to do so, especially as mortgage rates ease. Buyer confidence often improves as mortgage rates gradually fall. As of December 31, 2025, Freddie Mac reported the average 30-year fixed mortgage rate at 6.15%, about 0.76 percentage points lower than a year earlier.

While most pending sales usually close, REALTORS® understand that there are cases where the contract doesn’t come through settlement. Deals can fall through due to appraisal gaps, financing delays or denials, changes in the buyer’s employment or financial situation, difficulties in selling an existing home, or title-related issues. Keeping an eye on these factors is particularly vital in a changing market, since they can affect contract timelines and overall market momentum. To more effectively monitor this trend, we recommend following our monthly Flash Survey Report, where REALTORS® share firsthand insights about whether they’re dealing with ongoing contracts or experienced any that have fallen through.

Looking ahead, continued moderation in mortgage rates could have a meaningful impact on Virginia’s housing market. Rising pending sales often translate into more closed sales in the months ahead, particularly if inventory levels remain elevated enough to support buyer choice. At the same time, declining rates may encourage some homeowners who have been holding onto ultra-low pandemic-era mortgages to list their homes, potentially easing supply constraints.

You might also like…

Whose House? A Look at Household Types in Virginia

By Dominique Fair - February 2, 2026

The traditional structure of an American household is alive and well but has shifted over the past 50 years to make way for more non-traditional ones. Virginia at… Read More

Key Takeaways from NAR’s 2025 Profile of Home Buyers and Sellers

By Sejal Naik - December 8, 2025

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of home buyers and sellers… Read More

The Shutdown’s Impact on the Housing Market

By Dominique Fair - November 3, 2025

The government shutdown, which started on Oct 1st, has left many of the 1.4 million federal workers without pay and is estimated to cost the economy between $7… Read More