Three Multifamily Market Trends from the Fourth Quarter of 2025

January 21, 2026

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key insights from the most recent report for the last quarter of 2025.

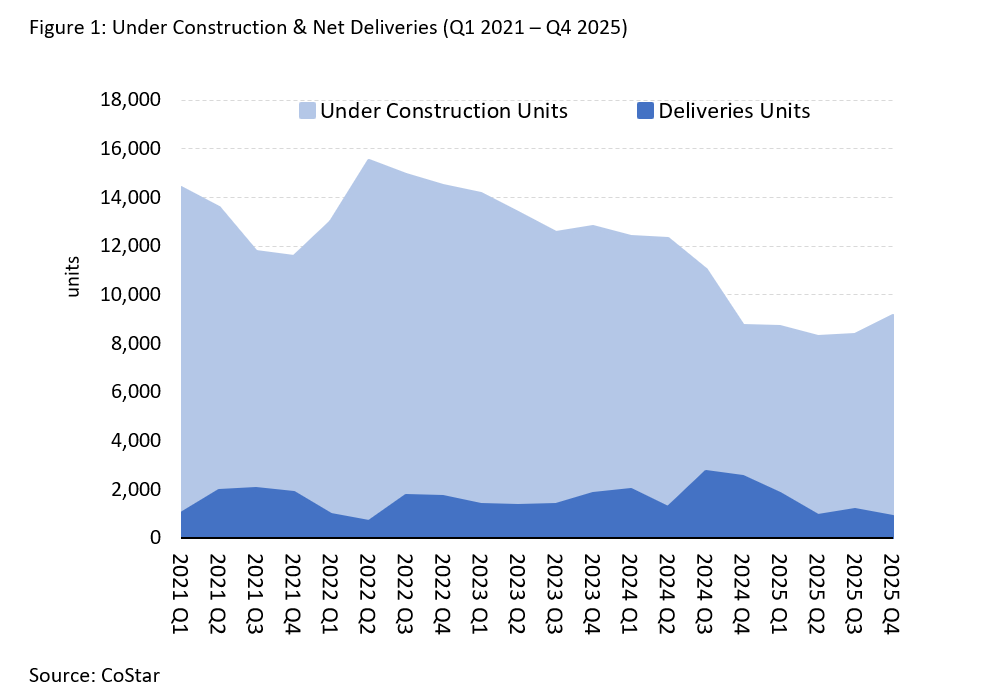

Delivery of new multifamily units continued to experience a slowdown in the fourth quarter of 2025 along with a declining construction pipeline.

There were 19,320 multifamily units under construction in Q4 2025, 8% lower compared to the same time last year. Among the metro areas, Northern Virginia and Richmond had the largest share of new multifamily construction in the Commonwealth. Deliveries of completed multifamily units slowed as well, with 3,689 multifamily units delivered in Q4 2025, which was 22% fewer units delivered compared to the same time last year.

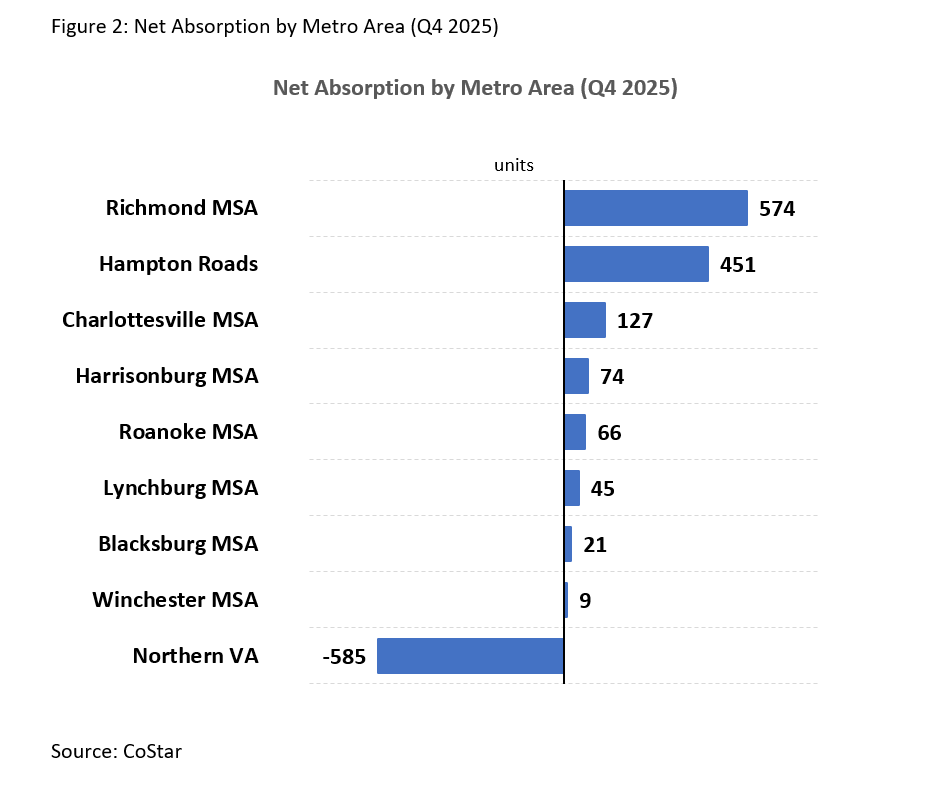

Net absorption slowed for the third consecutive quarter.

Net absorption–the difference between number of units leased and number of units vacated–was positive in Q4 2025 (822 units), meaning more space was leased than vacated in the market. However, net absorption slowed down from the prior year for the third quarter in a row. This indicates that while there is demand in the rental market, it is slowing down from previous periods. While Mid/High rise apartments saw positive net absorption, Garden style/low rise apartments saw more units being vacated than leased out in the last quarter of 2025. Richmond (574 units) led the list of Virginia metro areas for the highest number of leased spaces this quarter, while the Northern Virginia multifamily market experienced negative absorption in the fourth quarter of 2025 with 585 units of vacated space.

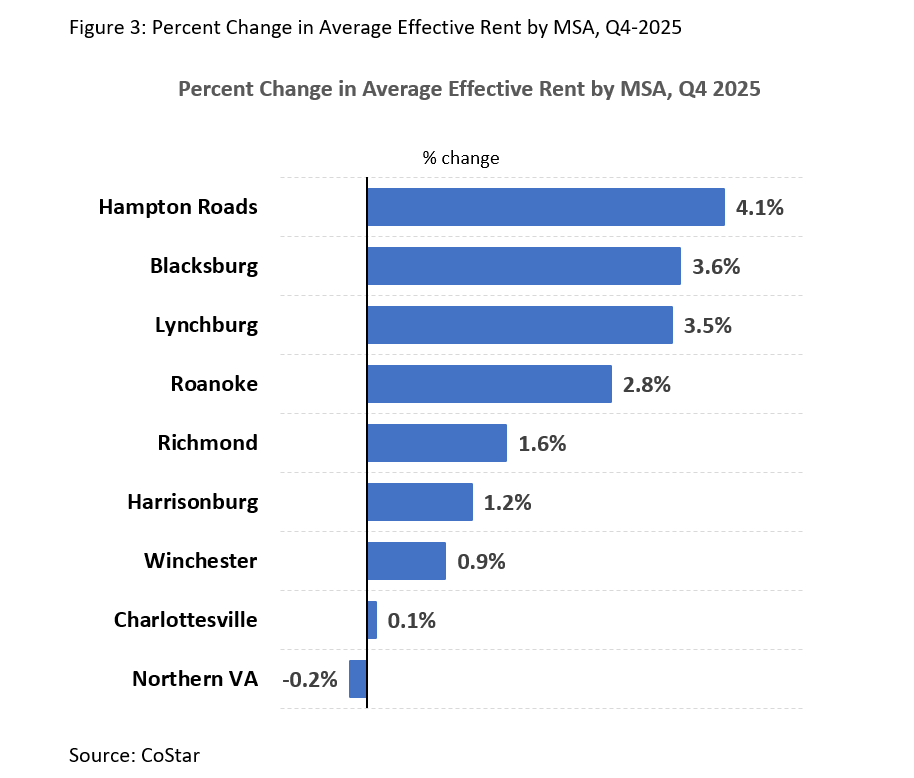

Rental prices continued their upward trajectory, with variability across different local markets.

The average effective rent per unit in Virginia was $1,794 in Q4 2025, increasing 1.1% from the same time last year, signifying that rental prices continue to climb. Rental prices went up in eight of the nine metro areas of the Commonwealth. Hampton Roads topped this list by experiencing a 4.1% increase in rent while Northern Virginia saw a rent decline (-0.2%).

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page. You can also find our latest infographic with these trends in a handy, at-a-glance guide on our infographics page.

You might also like…

Predictions for Virginia’s Housing Market in 2026

By Sejal Naik - January 21, 2026

2025 was a year of improving inventory conditions, a downward trend in mortgage rates in the latter part of the year, increasing prices, and a modest growth in… Read More

Mortgage Rates Edge Lower, Bringing Prospective Buyers Back into the Market

By Abel Opoku-Adjei - January 5, 2026

This year, Virginia’s housing market demonstrated signs of slowing compared to the rapid activity during the pandemic years, although overall activity stayed consistent. Both pending and closed sales showed ongoing buyer interest influenced… Read More

Key Takeaways: November 2025 Virginia Home Sales Report

By Virginia REALTORS® - December 22, 2025

Key Takeaways In November, home sales activity was slower than the previous year, likely due to a combination of the beginning of holiday season along with overall economic… Read More