How Many Homes Are Within Reach for Essential Workers?

October 6, 2025

Home prices continue to rise year-over-year, even though many Americans are finding it hard to afford a home. As of August, the median home price nationwide is $422,600, an increase of 2.0% from a year earlier, according to the National Association of REALTORS®. Despite sluggish sales during one of the busiest periods in the housing market, demand for homes remains evident. Location significantly influences home prices, and many areas are experiencing a housing shortage. The combination of high mortgage rates, rising home prices, and the housing shortage is leaving potential buyers on the sidelines. The Census Bureau reports that the median household income in 2024 was $83,730. Here in Virginia, that number is higher at $92,090. Essential workers, such as teachers, law enforcement, and healthcare professionals, are vital to thriving communities, but can they afford homes in or near the areas where they work? Let’s take a closer look at how much homes are selling for across Virginia.

While many households rely on dual incomes to purchase a home, this analysis focuses on individual wages to illustrate how affordable the market is for each occupation. The goal is to provide a clear snapshot of general housing affordability conditions faced by essential workers across Virginia.

As of 2025, approximately 73% of all homes sold in the Lynchburg metro area were priced under $400,000.

- 18% of homes sold were under $200k.

- 30% of homes sold were between $200k and $300k.

- 25% of homes sold were between $300k and $400k.

In this area, teachers earn an average annual salary of $47,399, with an estimated purchasing power of $165,897. This means they can afford to buy less than 20% of the homes available for sale in their local area. Law enforcement officers earn about $75,314 per year, resulting in a purchasing power of approximately $263,599, which allows them to compete for nearly 37% of the homes sold in the Lynchburg market. Healthcare workers in Lynchburg have an average salary of $83,023, equating to a purchasing power of around $290,581. This wage allows them to have access to nearly half the homes in the local area.

In the Blacksburg-Christiansburg-Radford metro area, approximately 69% of all closed sales in 2025 were valued at $400,000 or less.

- 19% of homes sold below $200k.

- 29% of homes sold between $200k and $300k.

- 21% of homes sold between $300k and $400k.

A local police officer earning approximately $69,500 in the metro area has an estimated purchasing power of $243,327, enabling them to afford roughly half of the homes currently on the market. Healthcare workers in this region earn an average wage of $65,925, which translates to approximately $230,738 in purchasing power. This allows them to afford around 45% of the local homes for sale. On the other hand, the average teacher with a salary of $46,812 has a purchasing power of $163,842, which gives them access to less than 15% of the listed homes.

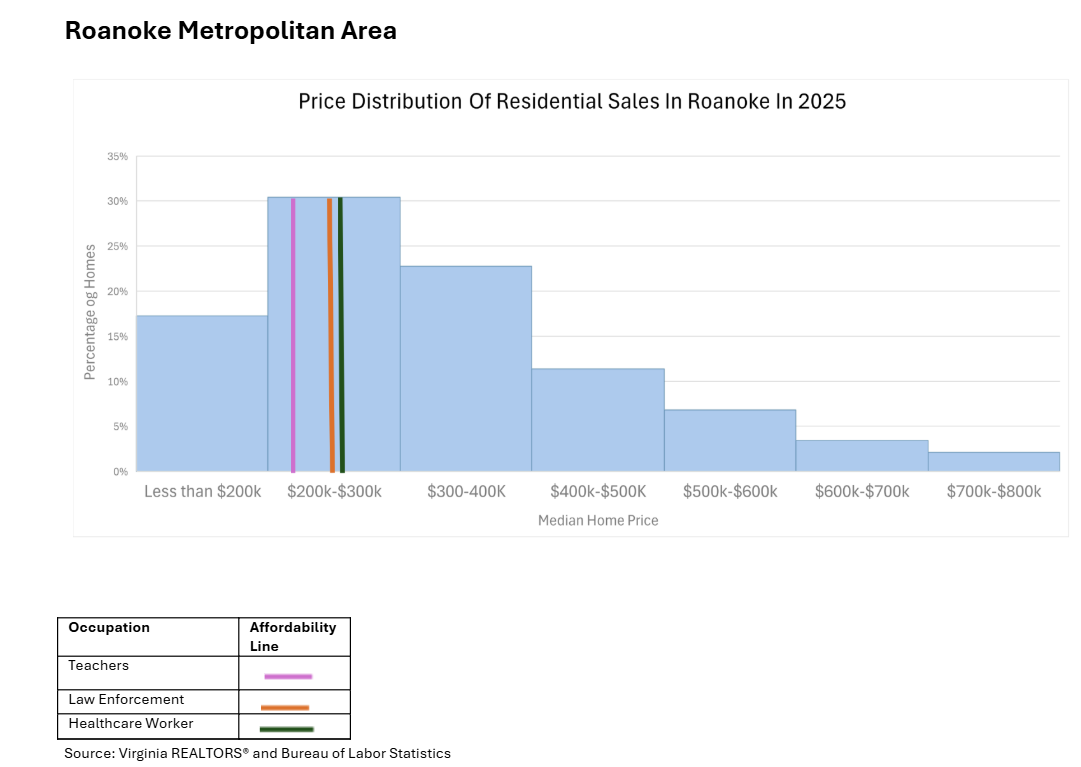

The Roanoke metropolitan area has seen 70% of home sales close below $400,000 in 2025.

- 17% of homes sold were below $200k.

- 31% of homes sold between $200k and $300k.

- 23% of homes sold between $300k and $400k.

The average teacher in the Roanoke region earns about $61,328 annually, supporting an estimated purchasing power of $214,648. This salary enables teachers to afford 22% of the homes on the market. Local police officers have a salary of approximately $71,122, which translates to a buying power of $248,927, allowing them to access 32% of available homes. However, healthcare workers in the area earn an average of $54,620, enabling them to afford 17% of homes in Roanoke, with a corresponding buying power of $191,170.

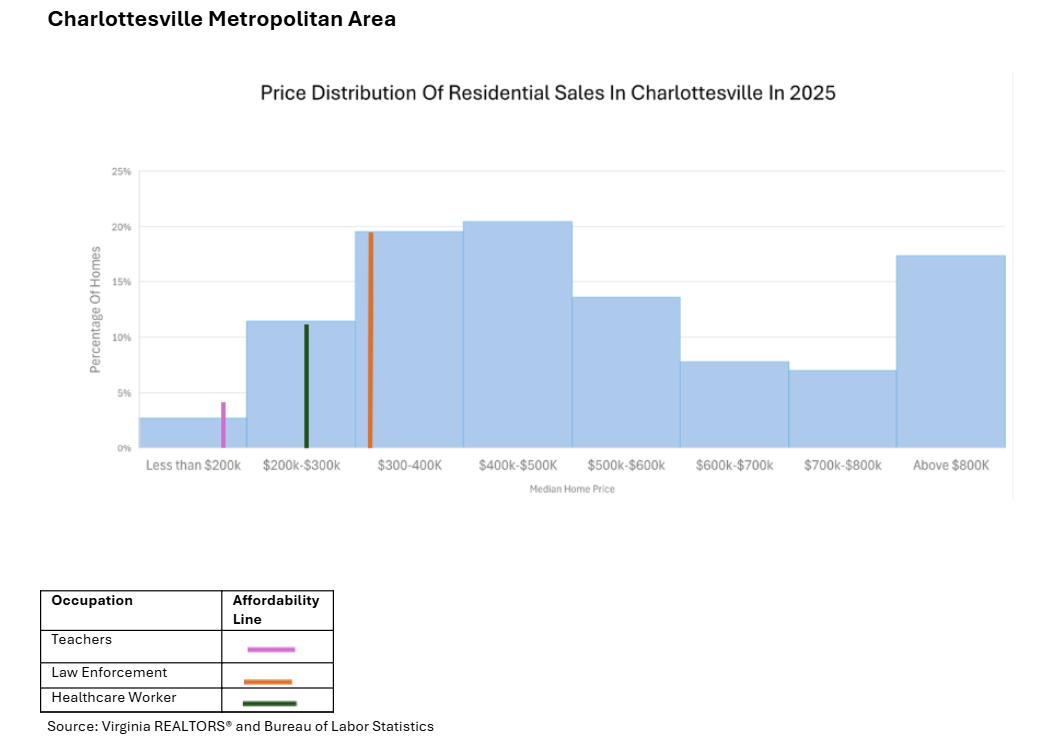

Nearly 60% of transactions in Charlottesville this year sold above $400,000, and less than 15% sold below $300,000

- 12% of homes sold were between $200k and $300k.

- 19% of homes sold were between $300k and $400k.

- 21% of homes sold were between $400k and $500k.

- 18% of homes sold were above $800k.

A typical local police officer in Charlottesville earns $87,899 annually, which enables them to afford an estimated $307,647, granting access to less than 25% of homes on the market. Healthcare workers, with an average income of $73,813, can only afford about 10% of local homes. Teachers, with a purchasing power of $195,990, are able to afford just 3% of homes.

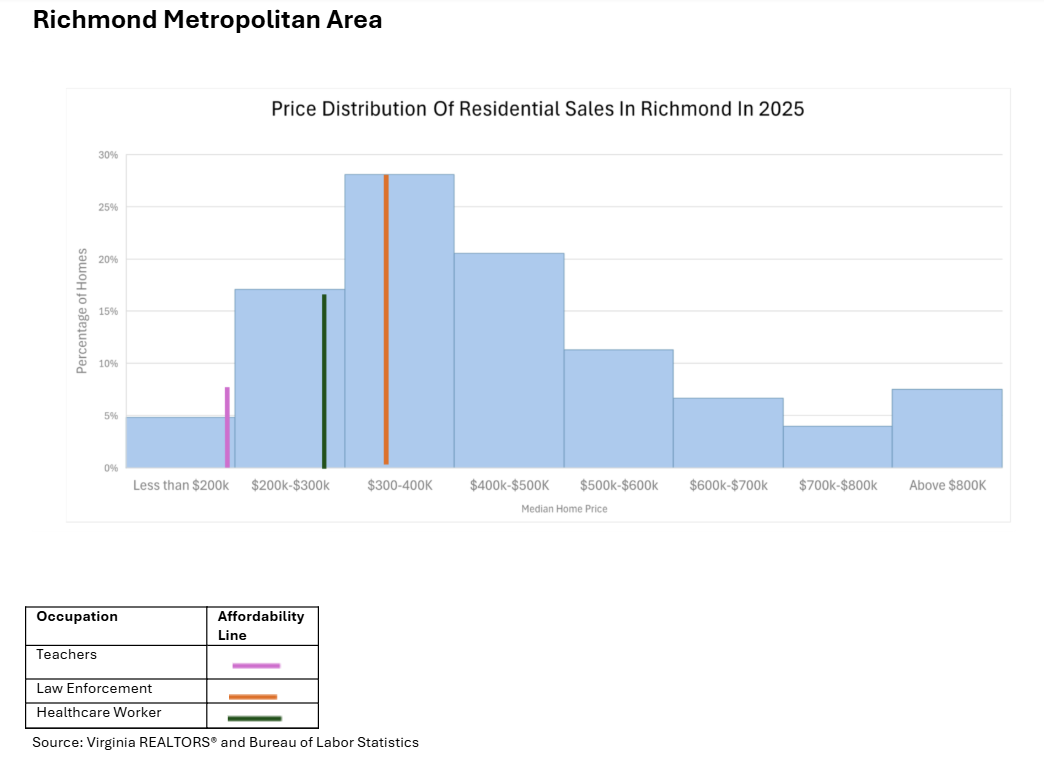

In 2025, the majority of homes in Richmond sold between $200,000 and $500,000.

- 5% of homes sold for less than $200k.

- 17% of homes sold between $200k and $300k.

- 28% of homes sold between $300k and $400k

- 32% of homes sold for over $400k.

An average teacher in Richmond can only afford less than 5% of the homes in the metro area, with an average wage of $56,005. The average salary of a healthcare worker in Richmond provides them with $286,727 in purchasing power, meaning they can afford approximately 18% of home prices. Local law enforcement earns an average of $94,943 in Richmond. This allows them to afford roughly 25% of listings in the metro area with a $332,301 buying power.

Nearly two-thirds of all completed sales in the Virginia Beach metro area sold for less than $400,000 so far in 2025.

- 8% of homes sold for less than $200k.

- 25% of homes sold between $200k and $300k.

- 29% of homes sold between $300k and $400k.

Healthcare workers in the metro area earn an average of $73,170, enabling them to afford about 21% of homes in Virginia Beach. The typical local police officer has a purchasing power of $242,645, which allows for the purchase of roughly 18% of available homes. Conversely, teachers in Hampton Roads, earning an average wage of $54,067, can only afford approximately 8% of the homes on the market, pricing them out of the market.

Northern Virginia has some of the highest valued homes in the state, creating affordability challenges for many people. So far this year, about 80% of closed sales exceeded $400,000, and 35% of all sales closed above $800,000.

- 9% of homes sold between $300k and $400k.

- 13% of homes sold between $400k and $500k.

- 13% of homes sold between $500k and $600k.

- 35% of homes sold above $800k.

An average law enforcement officer in Northern Virginia earns $135,758 annually, giving them a purchasing power of $475,153. Despite this high income, they can afford about 25% of the homes sold in the area. Healthcare workers, with an estimated income of around $309,288, can access roughly 7% of the homes sold this year in Northern Virginia. Teachers, earning an average of $70,213, can only afford about 3% of the homes available in their region.

Across the commonwealth, the data reveal a growing disparity between the incomes of essential workers and local housing costs. In most regions, teachers can afford fewer than 10% of homes, while higher-earning police officers and healthcare workers only compete for nearly a third of available listings. As home prices rise, the affordability crisis increasingly impacts the very workers who keep our communities safe, healthy, and educated. These issues are crucial for housing programs and policymakers to address, ensuring that essential workers don’t get left behind from the wide range of benefits provided through home ownership, and importantly, keep these important workers in our communities for years to come.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Mortgage Rates Edge Lower, Bringing Prospective Buyers Back into the Market

By Abel Opoku-Adjei - January 5, 2026

This year, Virginia’s housing market demonstrated signs of slowing compared to the rapid activity during the pandemic years, although overall activity stayed consistent. Both pending and closed sales showed ongoing buyer interest influenced… Read More

Key Takeaways from NAR’s 2025 Profile of Home Buyers and Sellers

By Sejal Naik - December 8, 2025

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of home buyers and sellers… Read More

The Shutdown’s Impact on the Housing Market

By Dominique Fair - November 3, 2025

The government shutdown, which started on Oct 1st, has left many of the 1.4 million federal workers without pay and is estimated to cost the economy between $7… Read More