What to Know from the JCHS 2025 State of the Nation’s Housing Report

August 4, 2025

In June, the Joint Center for Housing Studies at Harvard released their State of the Nation’s Housing report exploring how the housing market has changed and the effect it has on homeowners and renters across the county. Here are a few key findings from the report.

New Construction on the Rise as Multifamily Completions Surge

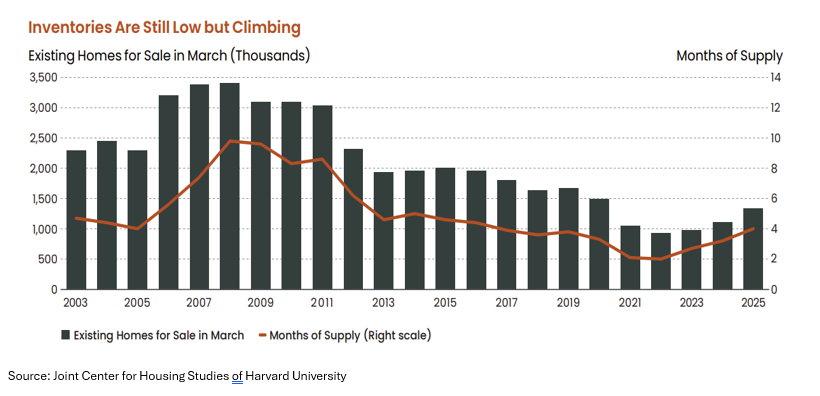

Inventory levels have jumped recently but that has not been reflected in the number of sales, which reached a 30-year low of 4.06 million in 2024. Affordability is the primary driver for the lack of sales with prices up 60% since 2019. Many home buyers have turned to new construction as a solution. New home sales made up 16% of all single-family home purchases last year, the highest it has been since 2005. The price of new homes has fallen to $420,300, only $7,800 more than the price of an existing home in 2024. Builders have also responded to the affordability challenges by building more townhomes and single-family rentals.

In 2024, multifamily completions soared, hitting a four-decade high of 608,000 units. Completions went up in every region but nearly half of them (48%) occurred in the South. With more inventory on the market, asking rent slowed to 0.8 % in the first quarter of 2025. Despite the rise in completions and cool down in rent growth, the rental market is seeing lower construction levels with starts down 25% from the previous year.

Rising Housing Costs are Affecting Buyers and Lower-Income Homeowners

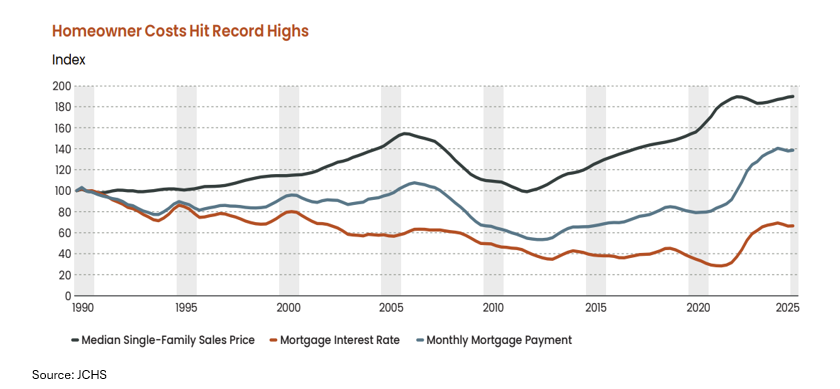

The cost of buying and owning a home has risen considerably over the last few years. Housing payments have surged going from $1,445 in 2021 to $2,570 last year, as interest rates hover near 7%. First-time home buyers are particularly affected by affordability issues with most needing to make $126,700 to buy a median priced home ($412,500) in 2024, up from the $79,300 needed in 2021. This prices out almost 8 million renter households. Households of color are also facing financial challenges with only 7% of Black renters and 11% of Hispanic renters able to afford the median price home last year.

Individuals who own their home but have lower incomes have been greatly impacted by higher housing costs. Of the 10.9 million homeowners with incomes below $30,000, 8 million or 74.2% of them were cost burdened, the highest burden rate in more than 20 years. Median real housing costs went up 4% for this income group between 2013 and 2023 as their residual income fell 23%. Those homeowners aged 65 and older have seen their cost-burden rate rise from 24.2% in 2019 to 27.6% in 2023.

Older People and Immigrants Drive Population and Household Growth

The number of households headed by young people (those under age 45), slowed this past year to 490,000, down from the average of 690,000 in the past five years. Lower population growth and affordability are two key reasons for this drop-off. As younger households saw their numbers dip, households aged 65 and up increased and currently make up 28% of all households in the country. This shift is in large part due to the size of the Baby Boomer generation, who typically live in smaller households due to demographic changes rather than economic ones. Per the JCHS report, Baby Boomers will add 5.5 million households over the next ten years.

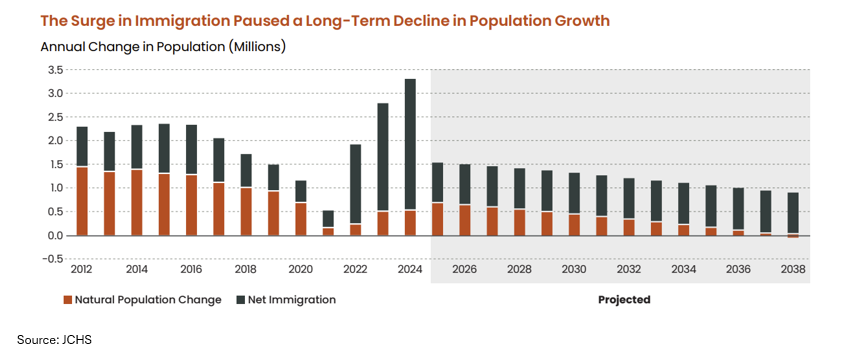

Immigration has become the primary driver of population growth over the past few years. Between 2022 and 2024 there was an average of 2.3 million immigrants a year, up from 830,000 the decade before. This population was responsible for 55% of the annual household growth in 2023, adding nearly 800,000 households. Immigration has staved off population declines with the natural population change (births minus deaths) falling from 1.2 million on average to 412,000 in the last two years. The U.S. Census Bureau projects that 8.6 million new households will form between 2025 and 2035 if net foreign migration stays at an annual rate of 900,000.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Key Takeaways from NAR’s 2025 Profile of Home Buyers and Sellers

By Sejal Naik - December 8, 2025

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of home buyers and sellers… Read More

The Shutdown’s Impact on the Housing Market

By Dominique Fair - November 3, 2025

The government shutdown, which started on Oct 1st, has left many of the 1.4 million federal workers without pay and is estimated to cost the economy between $7… Read More

How Many Homes Are Within Reach for Essential Workers?

By Abel Opoku-Adjei - October 6, 2025

Home prices continue to rise year-over-year, even though many Americans are finding it hard to afford a home. As of August, the median home price nationwide is $422,600,… Read More