Key Takeaways: December 2025 Virginia Home Sales Report

January 26, 2026

Key Takeaways

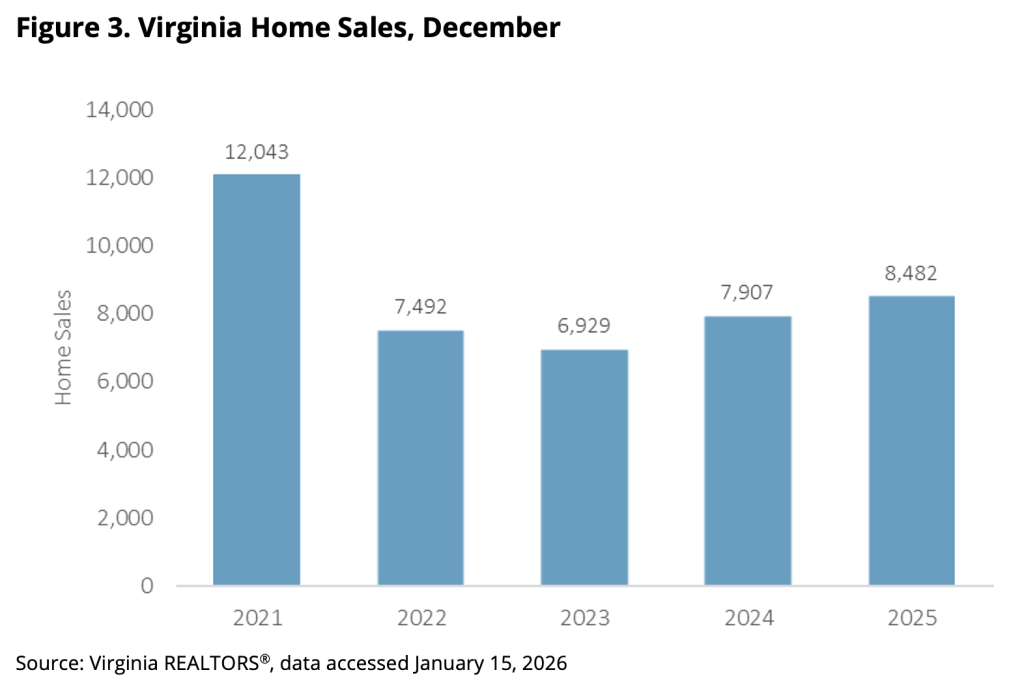

- 2025 home sales activity ended on a strong note, in what had otherwise been a sluggish year in Virginia’s housing market. There were 8,482 homes sold in December 2025 statewide, up 7.3%, or 575 more sales than December 2024. Annual sales totals for 2025 outpaced 2024 by 1.2%, reaching 103,722. This is still well below pre-2020 sales levels, and reflects the continued high-rate, high-price, low inventory environment that has stifled the market over the past several years.

- Home prices continue to rise in most parts of the Commonwealth, but the pace has eased. The statewide median sales price in December was $415,000, up about $1,500 from a year ago (+0.4%). The annual median sales price in Virginia rose to $425,000 this year, up 3.2% from 2024.

- The additional sales this month boosted the sold dollar volume by nearly $360 million compared to last December (+8.8%). Sold volume outpaced last month (November) by more than $462 million, which is larger than usual for this time of the year.

- Listing levels continue to improve. There were 19,631 active listings at the end of December across Virginia, an influx of 2,450 listings compared to this time a year ago (+14.3%).

Outlook

The 2025 housing market ended on a strong note despite being relatively sluggish for most of the year. With mortgage rates falling and more inventory out there, could this lead to more sales in 2026? Here are a couple things to watch that could influence the market:

- Additional inventory, strong pent-up demand, and gradual improvement with mortgage rates are expected to fuel home sales activity in 2026. 2025 saw inventory conditions improving across the local markets of Virginia. In most months of the year, inventory levels were higher than in 2024. This was due to a combination of increasing new listings (more sellers entering the market) and active inventory (homes staying on the market for longer). We expect this trend to continue in 2026. Furthermore, we expect more newly built single-family homes to enter the housing supply. All this is likely to provide potential buyers with more options and also spur move-up buyer activity.

- Mortgage rates are likely to continue their gradual decline and stabilize over the next 12 months. After starting 2025 close to 7%, mortgage rates have been relatively stable in recent months, hovering below 6.5% for nearly five months. In fact, just last week, the rate on a 30-year fixed rate mortgage dropped to its lowest level in more than 3 years at 6.06%. More stable and lower mortgage rates will likely entice more move-up buyers to enter the market as the lock-in effect loosens.

Read the full December 2025 Virginia Home Sales Report for detailed market trends and insights.

You might also like…

Home Price vs. Household Income in Virginia

By Sejal Naik - March 2, 2026

Affordability constraints are talked about often when discussing the housing market situation in Virginia. Potential first-time home buyers, especially, have been in a tough spot as they look… Read More

Key Takeaways: January 2026 Virginia Home Sales Report

By Virginia REALTORS® - February 23, 2026

Key Takeaways There was a modest uptick in sales activity statewide to start the year. There were 5,881 home sales in Virginia in January 2026, outpacing last January… Read More

Building Permit Trends and Impacts on Housing

By Abel Opoku-Adjei - February 20, 2026

Before housing construction begins, a project must go through a complex permitting process in the local area. While permits may seem like a routine step, builders nationwide have raised concerns about how complex and time-consuming this process is. Delay… Read More