Women’s Homeownership Trends in Virginia

March 16, 2023

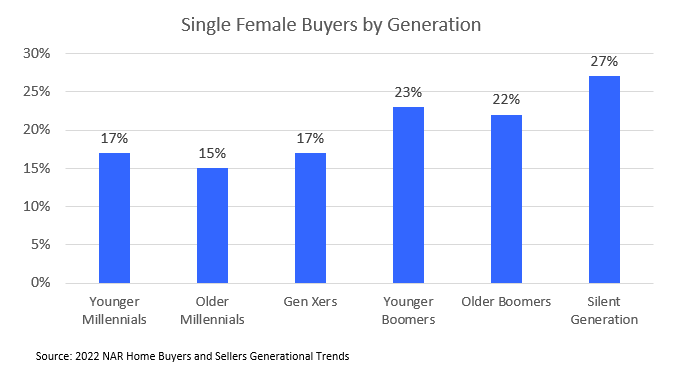

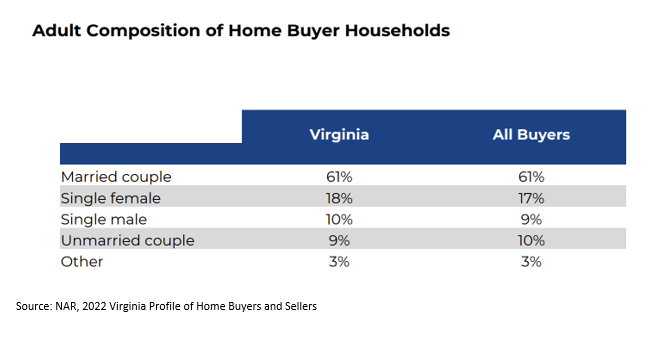

Women have made many strides over the past century. From gaining voting rights in 1920, to the Equal Credit Opportunity Act of 1974, which prevented lenders from discriminating against credit applicants based on sex, race, and marital status. As we fast forward to today, single females make up 17% of recent buyers, making them second only to married couples in the home-buying market. Let’s take a look at the trends among this growing demographic.

As the age of single female buyers increased, their income fell.

The median age of a single female buyer is 56 years old, placing them in the Gen Xers category, which has the highest household median income across all generations at $125,000. For the group of single female first-time buyers, the median age went from 34 years old to 38 years old in 2022. This is most likely due to the rise in interest rates and home prices as buyers waited for the market to cool down. As the age of single female home buyers increased, their income continued to go down with the median household income falling from $58,300 to $51,400.

Credit Card Debt and Down Payments

According to the NAR profile of Home Buyers and Sellers, 11% of single female buyers reported that saving for a down payment was the most difficult part in the home-buying process. Among those single female buyers, 42% said the expense that delayed them from saving for a down payment or home purchase the most was credit card debt. With the rising cost of food and shelter, credit card usage increased as a way to offset cost and savings began to drop. The personal savings rate fell from 7.5% at the end of 2021 to 4.5% in 2022 according to the Federal Reserve. This drop is reflected in the share of female buyers who used their savings as the main source of down payment, decreasing from 55% to 43% in 2022.

Buying a Home

Single female buyers were more likely to own their home rather than rent before buying. The number that owned a previous home rose from 44% to 53%, while those that rented an apartment or home fell from 39% to 28% last year. When going through the mortgage application process, 28% of single female buyers said the home-buying process was easier than they expected, while 42% said that it was not difficult or no more difficult than they anticipated. At 72%, single family detached homes were purchased the most by single female home buyers and the median size of a home purchased went from 1,510 square feet to 1,500 square feet in 2022.

Single women outpace single men in homeownership.

Although single women tend to make less than single men, they are still becoming homeowners at a higher rate. According to an analysis by Lending Tree, single women own roughly 10.76 million homes in comparison to single males with 8.12 million homes. In Virginia, of the 2.2 million homes that were owner-occupied in 2021, 13.18% were owned and occupied by single women compared to 9.67% by single men. One of the contributing factors to this growth is that single women are more willing to cut spending on entertainment, clothes, and non-essential items than single men. Single women are also delaying milestones such as marriage and pursuing homeownership on their own. The 2022 Homebuyer Insights Report by Bank of America showed that 65% of single women choose to buy a home on their own versus waiting for marriage. As the demographics of homeowners change it is important to understand the factors that affect their home-buying decisions and how that impacts the market.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

5 Key Takeaways from the NAHREP 2023 State of Hispanic Homeownership Report

By Sejal Naik - April 17, 2024

In March 2024, the National Association of Hispanic Real Estate Professionals (NAHREP) released its 2023 State of Hispanic Homeownership Report. Using data from surveys conducted by various public… Read More

3 Multifamily Market Trends from the First Quarter

By Dominique Fair - April 16, 2024

For the last three years, the multifamily market has seen high demand, double digit rent growth, and increased construction to meet demand. These trends are expected to shift… Read More

Virginia’s Housing Market Sees Largest Influx of New Listings Since 2021

By Robin Spensieri - March 29, 2024

According to the February 2024 Virginia Home Sales Report released by Virginia REALTORS®, pace in Virginia’s housing market picked up last month. There were 6,733 homes sold statewide in February,… Read More