Forbearance Periods Ending Does Not Mean Foreclosures Are Beginning

July 8, 2021

During the COVID-19 pandemic, millions of homeowners took advantage of forbearance programs offered by their lenders. These programs were designed to allow mortgage holders to pause their payments if they were facing financing uncertainty. Eventually, however, these forbearance periods end and homeowners will need to resume their mortgage payments or refinance the loan.

Some analysts have raised alarm bells that the end of forbearance periods means that we will begin to see an onslaught of foreclosures. However, assuming continued steady improvement in the economy and no COVID-19 resurgence, there is simply no evidence to suggest that we will see a significant influx of foreclosures on to the market.

Few Loans Are in a Forbearance Program

According to the Mortgage Bankers Association, as of June 27 2021, about 3.87% of all mortgages were in forbearance, which is down from 4.4% a month ago. This share means that there are an estimated 1.9 million homeowners currently in a forbearance program.

The rates of forbearance are even lower for loans back by Fannie Mae or Freddie Mac; just 2% of these loans are in forbearance compared with 7.92% of portfolio loans and private-label securities. But forbearance rates are declining for loans of all types.

These shares represent a tiny fraction of the overall mortgage market, but even these figures overstate the potential number of homeowners in financial distress. According to the MBA survey, one quarter of homeowners who entered into a forbearance program have continued to make mortgage payments during the forbearance period.

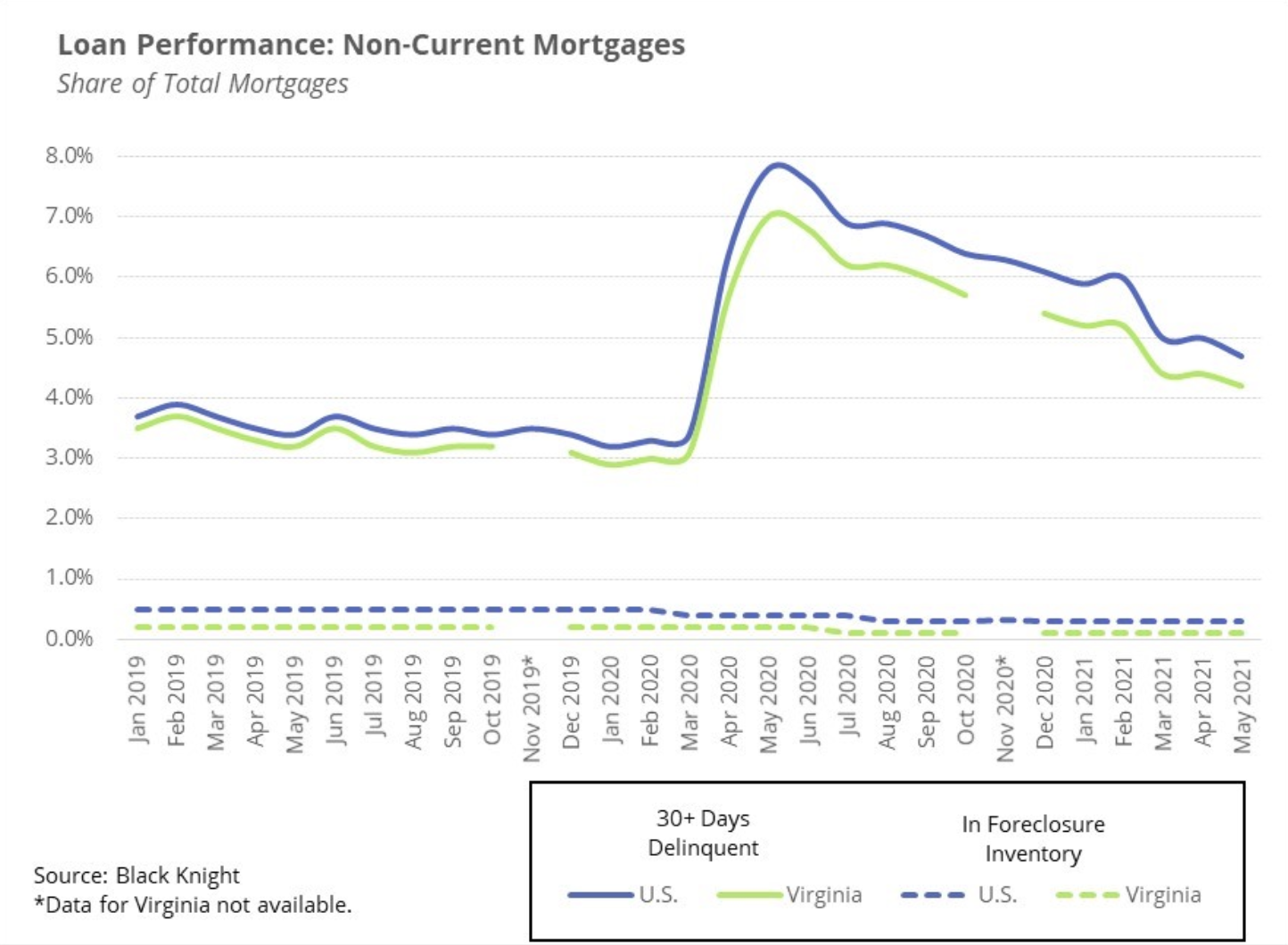

Delinquency and Foreclosure Rates Are Low

Black Knight tracks state-level data on mortgage delinquencies and foreclosures. In May 2021, about 4.2% of home loans in Virginia were at least 30 days delinquent and just 0.1% were in a formal foreclosure process. While delinquency rates are slightly elevated compared to 2019, the number of loans at risk of entering into foreclosure has been steadily declining since the summer. In a typical month, an estimated 0.2% of loans are in some stage of the foreclosure process. If the current foreclosure rate in Virginia doubled, it would just reach the long-term average.

The End of Forbearance Does Not Mean Foreclosure

While exiting forbearance could be challenging for some homeowners, overall, there are several reasons to expect that existing homeowners will be able to manage the financial challenge and that the overall housing market will not be negatively impacted by a wave of foreclosures:

- The sheer number of home loans in a forbearance program is very small. If Virginia looks similar to the U.S., fewer than four percent of all mortgage holders are currently in a forbearance program.

- Forbearance requests have slowed considerably, meaning the number of new entrants into a forbearance program is gradually heading towards zero.

- Mortgage rates remain incredibly low, offering existing homeowners the opportunity to refinance their loan at a lower rate, thereby lowering their monthly payment.

- Lenders are working with mortgage holders to set up loan modifications so that homeowners can begin getting current on their payments.

- The fast-paced housing market and rising home prices further minimize foreclosure risk. If homeowners are unable to make payments, they will be able to list their home for sale and attract many potential buyers, allowing them to get out of their loan.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

You might also like…

5 Key Takeaways from the NAHREP 2023 State of Hispanic Homeownership Report

By Sejal Naik - April 17, 2024

In March 2024, the National Association of Hispanic Real Estate Professionals (NAHREP) released its 2023 State of Hispanic Homeownership Report. Using data from surveys conducted by various public… Read More

3 Multifamily Market Trends from the First Quarter

By Dominique Fair - April 16, 2024

For the last three years, the multifamily market has seen high demand, double digit rent growth, and increased construction to meet demand. These trends are expected to shift… Read More

Virginia’s Housing Market Sees Largest Influx of New Listings Since 2021

By Robin Spensieri - March 29, 2024

According to the February 2024 Virginia Home Sales Report released by Virginia REALTORS®, pace in Virginia’s housing market picked up last month. There were 6,733 homes sold statewide in February,… Read More